Transcontinental Realty Investors

Too many concerns about asset values & corporate governance - avoid

Transcontinental Realty Investors owns ~2,300 residential units, 3 material office properties, and 1,843 acres of land. The stock trades at 0.3x reported tangible book value – this is the obvious attraction. However, real estate holdings need to be impaired and there are also questions about receivables from related parties. The recent treatment of public shareholders of IOR, a listed subsidiary, should make TCI public shareholders weary, as should concessions offered to related party debtors. TCI probably trades below liquidation value, though with poor governance, insiders may be the main beneficiaries. TCI is one to avoid.

Ticker: TCI

Share Price: $28.9

Market Cap: $249 million

History

TCI began operating in 1984. Prior to 2000 it had qualified as a REIT, though from that year, due to concentration of ownership, it lost this designation.

As of 2002 it held 128 investment properties, mostly multifamily residential and office. Most of the assets were in Texas. It also had a portfolio of mortgage notes.

By the end of 2009 net debt-equity reached ~450%. Gearing may have prompted asset disposals and debt reductions from 2010.

Deleveraging lasted through 2014. In the 5Y period, its portfolio of multifamily units declined to ~6,000 from ~11,400, while square footage of office property fell to 1.8 m from 5.1 m. It also reduced its land bank acreage by 40%.

From 2015 it resumed growth in multifamily residential though did not make any additions in office.

In 2018 it entered into an agreement with Macquarie and other parties to create a JV. TCI contributed a portfolio of residential properties and projects under construction and received cash consideration of $237 m.

In 2022 it recorded a $738 m disposal gain related to assets held by the JV with Macquarie. Its reported tangible book value per share increased to $95 from $41 in 2021.

Operations

TCI owns multifamily and commercial properties, mostly in the southern US. It also invests in land (held for appreciation or development) and mortgage notes receivable.

TCI has no employees. The company has commercial agreements in place with Pillar Income Asset Management, a related party via the same ultimate controlling shareholder, to manage the day-to-day operations in addition to making investment recommendations to the TCI board. Pillar earns an annual fee of 0.75% of the gross asset value, 7.5% of the adjusted net income, and can earn additional compensation for other services.

Its property portfolio includes:

(i) Multifamily – 14 properties with 2,328 units. Nearly half of the units are in Texas. Most sites were constructed between 2000 and 2010. The portfolio is carried at $341 m, 68% of total real estate, at year-end 2023.

(ii) Commercial – 4 office buildings with combined 1.05 m square feet. The major assets are in Dallas. The portfolio is carried at $91 m, 18% of total real estate.

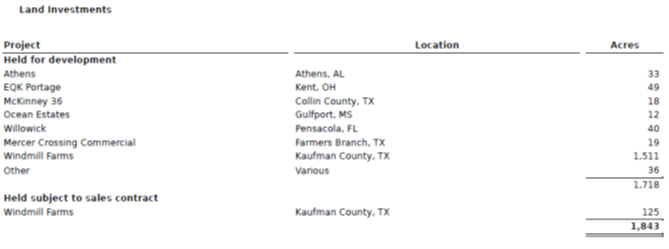

(iii) Land – 1,843 acres of developed and undeveloped land. ~90% is at the Windmill Farms development in Kaufman County, Texas. Land is carried at $69 m, 14% of total real estate.

Recent Trends

Multifamily residential has performed well. Occupancy was 93% in 2023, higher than 90% in the previous year. Gross rental income was +4% YoY in 9M 2024 and segment EBIT +7%. With no change in the portfolio, these are like-for-like figures.

Data from rent.com presents a reasonable picture of the individual markets in which TCI owns multifamily properties. For 1-bedrooms, the median rent increase was 9% YoY as of February 12, which is partially offset by a 6% decline for 2-bedrooms.

Office has been a disaster. In 2023 the vacancy rate was 47-59% for TCI’s major office properties. 9M 2024 shows things have gone from bad to worse. Commercial segment revenue was -15% and EBIT -27%. What is the problem? Dallas is oversupplied, which an office vacancy rate of 26% - above the national average. TCI’s buildings are probably outdated, with Browning Place having been built in 1984.

It is pursuing 5 development projects in Texas and Florida, with a total cost of about $230 million. Most will be completed in 2025.

Asset valuation

The investment case for TCI largely relates to the asset valuation. However, the true asset values may be well-below reported amounts. Thoughts:

· Office property surely needs to be impaired. Annual EBIT is running at ~$3.5 million. The $89 million carrying value of the properties implies a cap rate of <4%. Bloomberg puts the sector at a cap rate of 8.9%. Using an 8.9% cap rate, these buildings are worth $39 million. Listed office REITs can serve as a reality check to the valuation. VNO and KRC, which have both published their 2024 10-Ks, carry their office property at cap rates of 10-11%, which would imply an even bigger write-down for TCI.

· Multifamily also looks overvalued. The annual net operating income may be $14 million. Carried at $310 million, the cap rate is 4.6%. Bloomberg shows a sector figure of 6.0%. Using that, the value declines by >$70 million. Once again, listed REITs are far more conservative in their valuation. EQR’s properties are on a 10% cap rate, and those of MAA are on 13%.

· The $139 million Receivable from a Related Party also gives me pause. This relates to Pillar. I haven’t found any explanation as to what the receivable relates. Pillar is a private company, so we don’t know its financial position. $139 million strikes me as a big amount for such a business. TCI disclosed that it provided a concession to Pillar on this receivable by changing the interest rate from Prime plus 100 bps to SOFR at the beginning of the year. That doesn’t provide a lot of comfort. Most of the Receivable is held in IOR, a listed subsidiary which trades on 0.6x tangible book. Perhaps the 40% haircut makes sense?

· Notes & Interest Receivable is carried at $128 million. Of this amount, $11 million is undergoing rescheduling with the borrower – i.e. the amount should be considered impaired. Another $61 m is to related parties, which carries additional risk. Perhaps a 25% mark-down is sensible?

· Other Assets are carried at $100 million. This line is not itemized. Working capital accounts? Something else? Due to lack of clarity, assume a 20% write-down.

As for Land, the per acre value is ~$37,400. This is much higher than undeveloped rural land (perhaps $4k per acre) though if it is suitable for housing or commercial development, it doesn’t strike me as excessive. No adjustments needed.

In sum, perhaps $235 million in write-downs are needed, which brings the per share net worth to $69 from the reported $96. Based on this, the stock looks attractive on paper. Keep reading.

Management & Corporate Governance

The corporate structure seems to have been inspired by a Korean chaebol. There are 3 listed entities:

· At the bottom is Income Opportunity Realty Investors, which trades under the IOR ticker. IOR is not much of a business. Total assets are $120 m, of which $109 m is an accounts receivable from a related party, Pillar Income Asset Management.

· TCI owns the bulk of its consolidated subsidiary IOR.

· American Realty Investors, which trades under the ARL ticker, consolidates TCI. ARL doesn’t have material assets or liabilities of its own.

In turn, ARL is 90% owned by Realty Advisors LLC. Keep following to the top and there sits a trust established for the benefit of the children Gene Phillips. Who was Gene Phillips? Quite a few press articles can be found about him. He was a real estate developer born in the 1930s who ended up a billionaire. His investors, it seems, didn’t do so well. The Wall Street Journal once described him as ‘the most controversial figure in publicly traded real estate’. Anyway, he moved on to the great development in the sky in 2019, leaving a wife and multiple children. And at least one much younger mistress, who wants her share of the moolah, according to a press report.

This may be a bit simplified, by I come up with the following corporate structure.

I can’t find any explanation as to why Gene Phillips’ empire was structured as such.

Lately there has been some movement. In December 2024 TCI made a tender offer to purchase up to 100,000 IOR shares at $18 per share, close to the market price. Perhaps due to the miserly offer price, and the low valuation (0.6x tangible book), holders of just 21,128 shares participated.

TCI explained that if it increased its ownership in IOR to >90%, then under the Nevada parent subsidiary merger statute (NRS 92A.180) it could force a merger without approval of owners. With its affiliate, it now owns 90.3%, which may allow it to pursue this merger. Another possible outcome is that IOR could be delisted from the NYSE for failing to meet minimum standards regarding the # of shareholders and # of shares publicly held.

What is the endgame? Could ARL use the same tactics on TCI? The siblings may have different financial situations and accordingly different preferences as to what to do with TCI and the rest of the empire. The eldest child, Bradford, has a successful career (he is President of Liberty Bankers Life Insurance Company). His siblings may be more eager to monetize daddy’s wealth.

Overall, it is hard to predict what will happen. Nothing occurring at TCI makes me confident public shareholders will benefit from any restructuring.

TCI has 5 directors. They are all non-executive. Officially they are independent, though 3 joined the board prior to 2010, making them look rather non-independent. None of them own shares in TCI.

TCI’s President & CEO is Erik Johnson. He has been in the role since May 2024. He has been an executive since 2020, and prior worked at Macerich, Scientific, and PWC. His predecessor was Bradford Phillips, a son of Gene Phillips.

Related party transactions are the major concern. Here’s a list from 2023:

· Pillar – TCI paid advisory fees of $9.2 million in addition to cost reimbursements of $3.7 million. In sum, that is 27% of rental income.

· Regis – TCI paid $0.4 million in property management fees.

· Development related – it paid an additional $0.4 million in development fees to Pillar and acquired land from Pillar valued at $8.8 million (but didn’t receive cash, merely a reduction in the receivable).

Another concern regarding related parties – the reduction in the interest rate applied to receivables. From January 2024 Pillar pays TCI SOFR, whereas prior to that it paid Prime + 100 bps. Largely due to this change, gross interest income was $17 million in 9M 2024 compared to $27 million in 9M 2023.

Also, why would TCI issue bonds on the Tel Aviv Stock Exchange, denominated in shekels? These bonds have since been redeemed. Nonetheless, sometimes when things don’t make sense it should be seen as a red flag.

Conclusion

TCI came on my radar when I saw the 0.3x price to tangible book multiple. But concerns about asset valuation and governance make it seem not worth the risk. It is one to avoid.

Disclaimer: The information contained in this report is for general informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities or other financial products. The opinions expressed in this report are those of the publisher and are subject to change without notice. Readers are advised to conduct their own research. The publisher does not guarantee the accuracy, completeness, or reliability of any information in this report, and disclaims any liability for any losses or damages arising from the contents of this report. The publisher of the report often invests in companies about which it writes.