Tiptree Inc (TIPT)

June 19, 2024

Share price: $16.09

Tiptree (TIPT) caught my eye about a year ago when its corporate presentation, available on its website, presented a sum-of-the-parts fair value of $27 compared to a stock price bouncing between $12 and $14. This was interesting. First, companies typically don’t publish fair value estimates of their own stock, probably to avoid liability. Second, Tiptree’s numbers were not completely crazy. There did seem to be hidden value in the key operating company, Fortegra, an insurer which had sold a minority stake to Warburg Pincus. Third, if the $27 fair value was valid, the stock was super cheap.

So, let’s explore the investment opportunity in Tiptree.

Some background on Tiptree

Tiptree is a holding company. Its predecessor was established in 2007 and operated as a private partnership. Tiptree was listed in 2013. At year-end 2013 its business consisted of life insurance & savings (via Philadelphia Financial), specialty finance, asset management, and real estate.

In 2014 Tiptree acquired Fortegra for $212 m, valuing it at 18x 2013 earnings from continuing operations. This transaction, over time, reshaped Tiptree.

Fortegra was originally known as Life of the South and was incorporated in 1981. It IPOed in 2010. At the time of Tiptree’s acquisition, Fortegra wasn’t really an insurer but more of an ‘insurance services’ company. Its biggest product area was payment protection, mostly credit life and disability insurance which financial institutions market to retail borrowers (usually sub-prime). Fortegra retained limited underwriting risk. It also offered business process outsourcing to insurers and engaged in wholesale insurance brokerage. Most revenue was in the form of service and administration fees, ceding commissions, and wholesale brokerage commissions (though in 2013 it disposed of the insurance brokerage operations).

In 2015 Fortegra was 74% of Tiptree revenue. Over the next few years this contribution would rise as Tiptree exited other businesses and Fortegra grew rapidly. In 2022, Warburg Pincus paid $200 for a 24% stake in Fortegra, valuing the insurer at $833 m. That year, Fortegra was 89% of Tiptree revenue.

In November 2023 Tiptree announced a plan to IPO Fortegra. The news sparked a rally in Tiptree shares – the ‘value unlocking’ catalyst for which the market had been waiting. A few weeks later the deal was shelved, and Tiptree shares tumbled.

Tiptree today

Tiptree has been involved in a range of businesses over the years and has also had a large minority investment in public markets. Much of this is now gone. Tiptree’s activities as of 1Q 2024:

· Fortegra - accounted for 96% of revenue.

· Tiptree Capital – accounted for 4% of revenue. Within this, mortgage origination is 3% and other 1%.

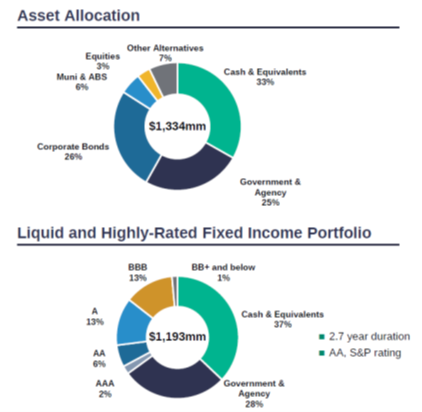

So, Fortegra is what matters for Tiptree. What exactly does it do? Fortegra is a specialty insurer which is focused on the commercial market. Distribution is via outside agents and brokers, including managing general agents, which have authority to underwrite as per Fortegra’s terms and conditions. Distribution partners receive variable compensation that captures the profitability of their policies, thereby aligning their interests with Fortegra shareholders. Much of Fortegra’s investment portfolio is managed by a fund management firm owned by Tiptree. The <3-year duration is appropriate given the liability mix will limit losses if bond yields rise.

Fortegra - business quality

Fortegra has a healthy track record for ROE and growth. Prior to the Tiptree acquisition, average ROE was 14% (2009-2013). ROE is unavailable for 2014 and can only be estimated from 2015-2017 based on Tiptree disclosure. Since 2018 Tiptree has separately disclosed Fortegra ROE. Bringing it all together, Fortegra estimated ROE since 2009 has been 12%. The clear trend has been for improvement, with 2023 ROE of 26% a record high. Perhaps more impressively, the CAGR of revenue over the 15Y period has been 25% (from $56 m in 2008 to $1,593 m in 2023).

The high and improving ROE is due to:

· Low capital intensity. Fees earned contribute ~25% of revenue at Fortegra. This compares to the <5% contribution for most P&C insurers. Insurers need to set aside capital against underwriting activities, but generally not against fee-earning services. Fortegra earns much of these fees from administration of auto and consumer goods warranty products, motor club programs, and other business process outsourcing, all of which are related to its insurance offering.

· Improving scale. Fortegra remains small compared to some of the giants of the US P&C insurance industry (Progressive has revenue of >$60 billion). Nonetheless, the growth incurred over the past 15 years has ended the problem of being sub-scale. This is evident from financial ratios. Operating costs (personnel, other, D&A) compared to revenues net of commissions paid stood at 23% in 2023 compared to >50% in the early 2010s.

· A focus on niche products. Standard personal coverage for auto and homeowners are commoditized products. Many of Fortegra’s policies afford it pricing power due the atypical risk coverage.

· Stable underwriting and expense management. Its combined ratio has ranged from 90-93% since 2017.

Outlook - is it possible that Fortegra is headed for trouble?

The historical record suggests Fortegra has lots of momentum for profitable growth. However, for financial institutions, rapid growth can be difficult to manage or worse, a harbinger of future problems.

P&C insurers can get into trouble in many ways. These include poor underwriting, under-reserving for losses, mismanaging the investment portfolio, and insufficient reinsurance or purchasing reinsurance from financially weak counterparties.

Liability triangles show that Fortegra has historically underwritten short tail risks and that it has historically been prudent in its reserving policies. Prior years development data supports this – in sum, from 2016-2023 adverse development has been $5 m, an immaterial amount. Annual volatility of prior years development has been low.

Perhaps the biggest concern is the rapid shift in the premium mix. Commercial property & short tail is now the biggest business line but was virtually nil in 2019. It has also grown in some liability lines. Fortegra actively recruits experienced underwriters to expand into new areas. Management argues this limits risk, though this is something to watch going forward.

Management & corporate governance

There are two major shareholders. The Executive Chairman (Michael Barnes) owns 26% and someone perhaps best described as a past business associate (Arif Inayatullah) owns 10%. The later holder is not technically considered an insider and has no formal role in Tiptree.

Most directors are non-executive and have backgrounds in investment banking and fund management.

Overall, there is good alignment between public shareholders, directors, and senior managers. All directors own shares. Excluding the Executive Chairman, the average director holds ~97k shares, worth ~$1.6 m. Amongst the 3 senior executives not on the board, 2 hold material amounts of shares.

However, executive compensation is problematic. Tiptree’s 5 key executives (Exec Chair, CEO, President, CFO, and General Counsel) earned a combined $17 m in 2023. The bulk of this is merely salary and variable cash compensation. Compared to the PBT of $83 m, this is a big amount. Don’t forget, Fortegra is the workhorse within Tiptree, with its own management team (the CEO has been in place since 2007). Are all these costly bureaucrats at the holding company level really needed?

Valuation

Tiptree no longer publishes its sum-of-the-parts fair value estimate in its presentation material. It does seem like the appropriate way to value Tiptree, considering the private equity investors will be pushing for some type of liquidity event in the next couple of years.

My back-of-the-envelope calculation arrives at a similar figure to that of the company, though my numbers explicitly deduct the value of corporate overhead costs. Details:

· Fortegra – valued at the median P/E ratio for US P&C insurers, currently 16x. Arguments can be made in favor of both a premium and a discount. In part for simplicity’s sake let’s stick with the industry median. This values Fortegra at $2,022 m. Tiptree owns ~73% on a fully diluted basis, so its stake is worth $1,476 m.

· Tiptree Capital – this includes the mortgage origination operations and some other bits, including investments at the holding company level. Assume it is worth book value.

· The negative value of corporate overheads. Corporate overhead was $40 m in 2023, of which ~45% appears to be executive compensation. This can’t be ignored in the group valuation. Assuming this line grows at 2% per year and applying an 8.2% discount rate, the negative value of corporate overhead is a whooping $648 m!

Overall, the per-value share is $25.7, yielding upside of 60%.

The interesting conclusion is that were Fortegra to be sold, given the high cost of maintaining the status as a listed holding company, the best-case scenario would be for Tiptree to be liquidated with the proceeds paid to shareholders. This removes the holding company expense drag from the valuation, resulting in a fair value of $42.7/share, upside of 165%.

Conclusion

Overall, Tiptree is attractively priced. The catalyst is some corporate action regarding Fortega to crystallize this value. The timing is uncertain but would seem likely in the next 2-3 years. In line with such an event, the board needs to ensure value is not destroyed by the overhead costs at the holding company level.

Good question. So where available, I used the Fortegra unadjusted numbers. You can find the IPO prospectus that provides 2020-2022 figures. Then I was able to find 2008-2013 figures from the original listing. So in other years, use Tiptree adj figures or my guestimates.

Did your analysis of historical earnings for Fortegra use TipTree's adjusted earnings metric, or did you get rid of those adjustments?