Shares of high yield lender Regional Management sit ~60% below the 2021 peak. The company has faced higher credit losses as household budgets were stung by inflation. Trading at 0.7x tangible book, and with an enviable LT record for managing credit cycles, a normalization in earnings could spark a 50% return to $39.

History

Regional Management (RM) commenced operations in 1987 in South Carolina. Its founders were former World Acceptance executives. The company secured private equity funding in 2007. It remained profitable in 2008 and 2009. RM shares were listed in 2012. At that point it had 137,000 customer accounts and 146 locations in the south.

It didn’t take long for RM to disappoint following the IPO. In 2014 earnings fell by ~50% due to higher credit costs. Management pointed to loans outgrowing operational capacity and some poor underwriting as the company switched to a new vendor of credit data. This prompted a CEO change in 2H 2014 and a large increase in headcount.

From that point until 2019, RM posted annual growth in loans and profits as its physical footprint expanded.

RM suffered little in the early months of the pandemic due to government stimulus and management action (tighter lending standards for new originations, borrower assistance programs). In 2020 earnings declined due to operating costs growing at a faster clip than revenue and an increase in the cost of risk.

A record year for earnings followed in 2021.

Operations

RM lends to risker individuals under the Regional Finance banner. Basic facts:

530k active customer accounts. Based on outstanding loans, 30% of balances are to subprime customers (FICO score <620). Near prime customers are 35% (FICO 620-659). Prime customers (FICO score >660) are 36%. It avoids ‘deep subprime’. The average customers has a balance of ~$3,300.

Multi-channel distribution. Digital is ~30% of new originations. ‘Convenience checks’, in which individuals receive checks in their name in the mail, which effectively become a loan when they are cashed, account for ~25% of originations. Branch visits are the bulk of the remaining.

Products. RM has stopped writing new auto loans and providing retail financing. Installment loans are the only product, which the company sub-divides into ‘small’ ($500-$2,500, ~30% of total) and ‘large’ ($2,500-$25,000, ~70% of total). It also markets insurance products to borrowers, which account for 9% of gross revenue. Loans are fixed rate with up to 5 year maturities. The bulk of loans are priced at <36% APR.

Loan underwriting. It now uses a credit scorecard which captures >5,000 data points about an applicant. Most loans are secured by collateral though high charge-off rates imply these assets provide limited protection and instead are designed to give RM leverage over borrowers in cases of non-payment.

Customer repayment. ~80% of customer payments are made by debit card or electronic bank payment. Most other payments are via visit to a branch where the amount is settled in cash, check, etc.

Delinquency management. Branch staff are actively involved, and it also utilizes 3rd party collectors.

Business Quality

Since 2012 average ROE has been 16%. To put this in perspective, the mighty JP Morgan has produced 12% average ROE during this period. So not too shabby. 16% ROE suggests there is at least a weak moat around the business.

The secret to RM’s success, which is also the key to the sustainability of these returns, boils down to a few factors.

(1) Managing credit risk

Going back to 2007, the average net credit loss has been 8% per annum. With loans priced at ~35% on average, this is an acceptable level. Moreover, given the nature of the business, credit losses have been fairly consistent. The most recent guidance is for LT credit loss of 8.5% - 9.0%.

How has RM done this? These are banking basics - gathering customer information, analyzing borrower riskiness, monitoring outstanding loans, and management collections and overdue accounts. Also important - ensuring employees follow the rules. On paper it is simple, in practice difficult.

It is fair to question how much ‘extend and pretend’ is occurring. Some delinquent borrowers are eligible for deferrals or refinancing. RM has in recent years done far less of this. The volume of refinanced loans was $13 m in 2022, <1% of loans, compared to 3% in 2018. ABS prospectus data suggests ~5% of loans enjoy deferments 1-2x per year.

(2) Maintain access to funding

The funding mix is ~90% securitization, in which assets remain on-balance sheet, and ~10% revolving credit facility. Most debt does not mature until after 2029. Fixed-rate debt is 87% of total. It has unused capacity of $613 m (35% of loans) to provide liquidity.

(3) Avoiding the regulator’s wrath

Some may find RM’s business distasteful, unethical, or even falling under the definition of predatory lending. This puts the company at risk of regulatory scrutiny.

Several players in the industry have faced regulatory environment actions in recent memory, including One Main (deceived, misled customers and must pay up to $20 m in penalties and redress) and Lendup Loans (misled customers, must pay up to $41 m in redress). Years ago World Acceptance and EZCORP faced regulatory ire.

At the federal level, the Consumer Financial Protection Bureau (CFPB) has broad oversight over installment lenders. Interestingly, CFPB may have bigger fish to fry. It publishes a ‘Consumer Response Annual Report’ which looks at consumer complaints regarding the financial industry. First on the list, by a wide margin? Not high yield lenders but credit reporting firms such as Equifax, Experian, and TransUnion. In fact, these firms accounted for >75% of complaints received. To be fair, debt collection is the 2nd largest source of complaints, and this is relevant to RM. But looking more closely at debt collection complaints, most relate to phone and utility bills or credit card balances, not installment loans. In addition, the majority of complaints about debt collection relate to ‘attempts to collect debt now owned’.

In truth, concerns about high yield lending have existed for decades and the industry has not only survived but thrived. The counter argument made by high yield lenders remains valid - if regulated financial entities are forced out of business, low income households will turn to the local loan shark, which surely is not in their best interest.

(4) Ensuring new entrants do not compete away economic profit

It would be easy for fintech to dismiss RM as being a dinosaur. Most customer contact is via human employees physically located in a branch. Aside from the ~30% of loans which originate through the digital channel, little has changed since the pre-internet age.

Fintech is surely a threat to RM and over time a new entrant may get it right. But it hasn’t happened yet. The original peer-to-peer lender, Lending Club, never figured out how to make money with the business model and has since become a bank holding company. Upstart Holdings, which offers a marketplace matching commercial banks to prospective borrowers, all on the back of supposedly superior AI-based credit models, has struggled as of late and growth has screeched to a halt.

Perhaps there is merit in the old ways.

(5) Scaling fixed costs - an opportunity

There is an opportunity for RM to scale the fixed cost base, something it has yet to achieve. Operating costs, as a % of receivables, have never followed a straight downward trajectory. As noted, the credit problems of 2014 led to a surge in hiring which hurt cost ratios. Broad wage inflation in the last couple of years has also caused cost ratios to reset to a higher level. Increased use of digital and a move to smaller branches with fewer staff may allow RM to capture scale benefits over time.

Recent Developments & Outlook

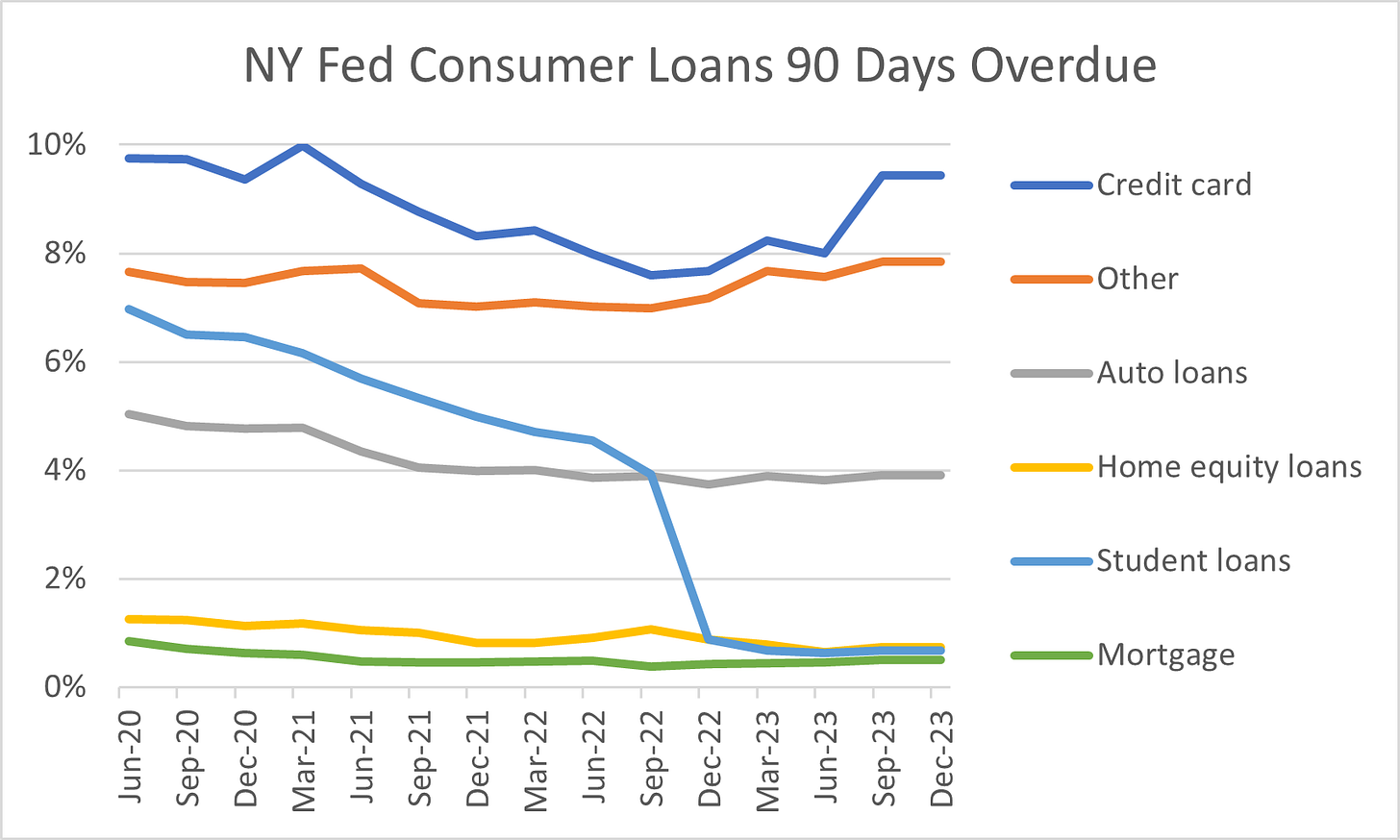

RM has struggled following peak earnings in 2021. Earnings declined 42% in 2022 and 52% in 9M 2023. The old bugaboo of credit quality has been the issue. Higher inflation has squeezed household budgets, making it more difficult to service loans. RM has tightened loan standards since late 2021, causing the natural seasoning process to occur. The company’s experience is not dissimilar from credit card issuers and other consumer lenders.

More recent data points have been mixed. The major concern is data from ABS servicing filings, which suggest credit performance has weakened in the past couple of months. More positively, Atlanta Fed GDPNow shows growth of +2% in 4Q and World Acceptance reported encouraging credit quality data for December.

Overall, it seems RM’s credit quality issues have been cyclical rather than structural. The company has proven an ability to manage cycles. If so, in a benign macro environment earnings can normalize, which look like this:

Pre-provision profit of $238 m, close to the level of the past 4 quarters.

Credit loss of 9%, or $158 m.

PBT of $80 m.

PAT of $63 m.

EPS of $6.39.

ROE of 19%.

Capital Allocation

In the past 4Y RM has returned cash of $148 m through dividends and buybacks, equal to 70% of profits.

Management & Corporate Governance

A combined 48% of shares are held by 5 institutions.

There are 8 directors, all with relevant backgrounds. This includes the CEO and a nominee of Basswood Capital, which owns 9%. Perhaps it is time to fresh up the board - the Chairman is 79 years old and has been on the board since 2012. Another director also joined in 2012 and is now 74.

The executive management team has been stable. The current CEO was appointed in March 2020, from the CFO position. Prior to that he worked at Citibank for many years. 3 of the 4 other executives joined later in 2020.

Directors and executives are aligned with public shareholders. Insiders own 8% of outstanding shares. This includes the CEO with 104k (valued at $2.7 m), the other 4 executive directors 22-37k shares per person, and average director holdings of 70k shares.

Valuation

Since listing, the shares have traded on median multiples of 1.2x P/TB and 9x P/E. A re-rating to 1.2x P/TB would bring the shares to $39, or ~50% upside. This upside justifies the risk that earnings may be slow to normalize.

Disclaimer: The information contained in this report is for general informational purposes only and does not constitute investment advice or a recommendation to buy or sell securities or other financial products. The opinions expressed in this report are those of the publisher and are subject to change without notice. Readers are advised to conduct their own research. The publisher does not guarantee the accuracy, completeness, or reliability of any information in this report, and disclaims any liability for any losses or damages arising from the contents of this report.