Natural Resource Partners (NRP)

Natural Resource Partners (NRP)

June 10, 2023

$48.30

Coal prices have corrected from recent highs in 2022, dragging down shares of companies benefiting from an undersupplied market. Though there is ST earnings risk, value is emerging. Natural Resources Partners (NRP) is an example of this opportunity. NRP is not a coal miner but an owner of mineral rights which are leased to producers. Its move into ‘carbon neutral’ activities may, over time, enable it to be seen as a play on the energy transition. There are sources of hidden value on the balance sheet. Yield to 2022 FCF is 28% and on a through-the-cycle basis may be 19%.

History

Arch Coal and WPP Group formed NRP as a limited partnership in 2002. It IPOed later that year. At year-end 2002 NRP had proven and probable coal reserves of 1.2 b tons.

From that point NRP grew rapidly through acquisition of mineral rights. From 2003-2010 it spent ~$0.8 b on such transactions. Reserves reached 2.3 b tons in 2010. With cash flow being distributed to unitholders, these acquisitions were financed largely with debt. NRP also diversified into mineral rights containing construction aggregates and oil & gas.

Financial performance was healthy during this period of expansion. Operating margin was >60%. Excluding 2006, it produced free cash flow annually. The unit price traded at $375 in March 2011, close to an all-time high. Investors who bought at the IPO and held until then enjoyed a total return of >500%.

From 2011, declining coal prices stung. It took a $161 asset impairment that year. Yet it continued to expand. In 2013 NRP acquired 49% of OCI Wyoming (now Sisecam Wyoming), which operates a trona mine and soda ash production facility, for $293 m. In 2014 there were more acquisitions - $200 m for a construction aggregates producer and $339 m for oil producing rights in North Dakota. Debt reached 205% of partners’ capital, at which point management pledged to refocus on balance sheet health.

The de-leveraging initiatives were successful over time and were aided by higher coal prices from 2017-2019 and again in the post-Covid era. By 2018 much of the non-coal assets had been sold, with the Wyoming associate a notable exception. Post-pandemic NRP began to reposition itself to participate in the energy transition.

Operations

NRP reports two segments.

1. Mineral rights (~75% of earnings)

NRP owns 13 m acres of mineral interests and other subsurface rights. These interests are leased to mining companies in exchange for royalties and other fees.

~95% of segment revenue relates to royalties and related income. The remaining ~5% stems from leases of transportation and processing infrastructure.

Within royalty and related income, ~90% relates to coal. Of coal royalty revenue, 70% is from metallurgical coal (used in steelmaking) and 30% is thermal (used to generate electricity).

The geographical distribution of major mineral rights where coal is extracted:

· Appalachia – generated 52% of the volume of coal sales in 2022 and there are 6 major properties.

· Illinois Basin – 34% of volume and 2 major properties in southern Illinois.

· Northern Powder River Basin – 1 property in Montana, contributing 13% of volume.

The major lessees are top 10 domestic coal producers:

· Alpha Metallurgical Resources – 31% of NRP revenue. Is publicly traded under the AMR ticker.

· Foresight Energy Resources – a privately-held company based in St Louis which discloses 2 b tons of coal reserves. It was 20% of NRP revenue.

Non-coal royalties:

· Oil & gas (~5% of segment revenue) – mostly located in Louisiana.

· Carbon neutral initiatives (~3%) – revenue stems from carbon sequestration, in which NRP has leased 140,000 acres for this activity.

· Other (<1%) – includes construction aggregates, industrial minerals, and timber.

Leases are typically structured as follows:

· Long-term in nature (typically 5-40 years at inception) with options to extent.

· Revenue is based on either % of gross sales or fixed price per ton of mineral mined and sold.

· Minimum payments are common.

2. Soda Ash (~25% of earnings)

This is the 49% ownership of Sisecam Wyoming. The company mines trona which is processed into soda ash.

The mine covers 24,000 leased and licensed subsurface acres in the Green River Basin. Surface operations are on 2,360 acres, of which 880 acres are owned. The site is accessible by road and rail. Trona is processed into soda ash onsite.

~50% of soda ash is exported, both to distributors and customers. In the US it has ~80 customers. Glass manufacturers are the major end users, followed by chemical and detergent manufacturers.

Business quality

Ignoring capital allocated to the associate, NRP has produced an average ROIC of 12% since 2005.

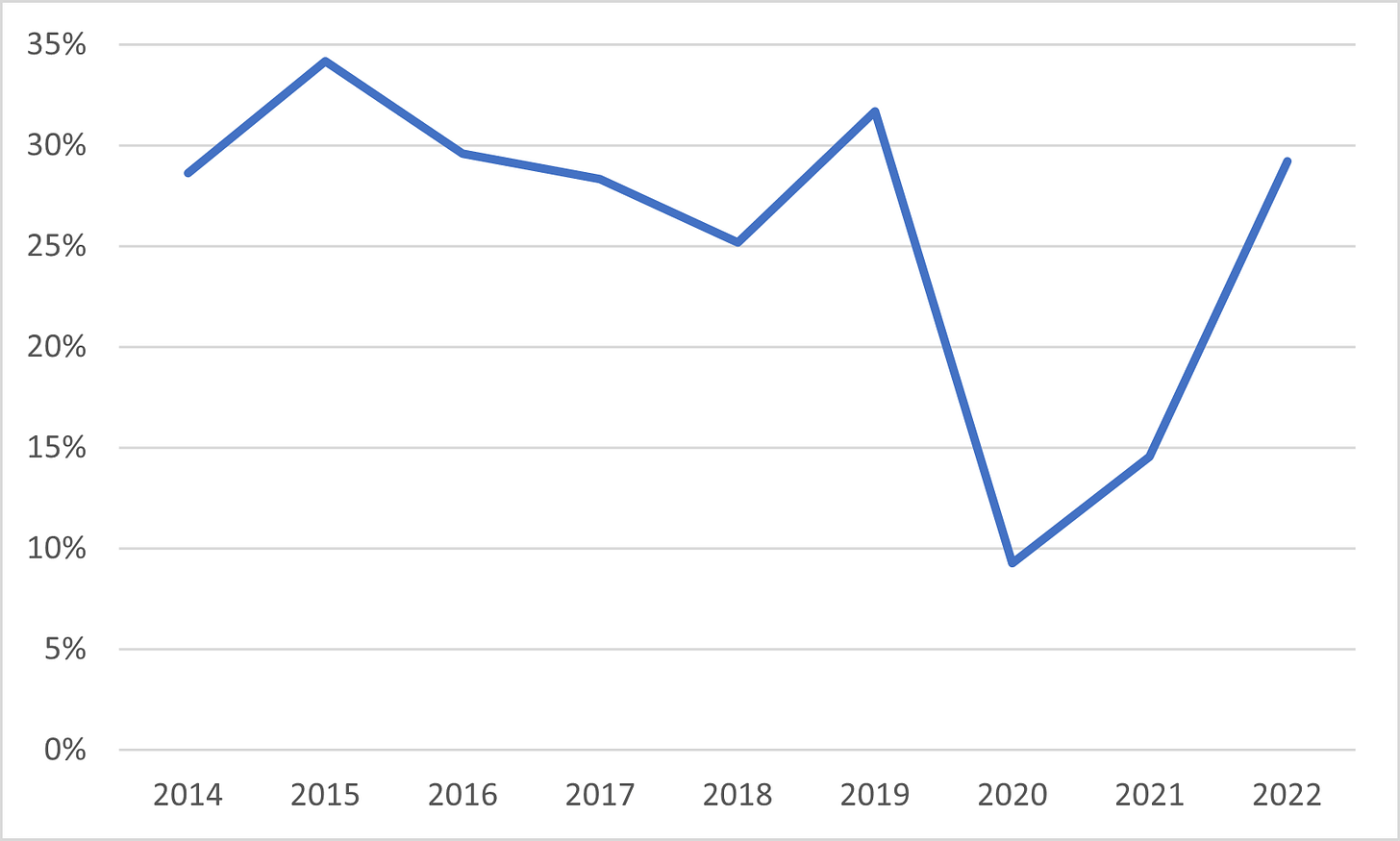

ROIC excluding soda ash associate

Before considering how it has generated an economic profit, the elephant in the room needs to be addressed. Yes, the US coal industry is in structural decline. 2022 production was ~50% of the 2008 level. Coal is dirty, natural gas is inexpensive, and renewables enjoy policy tailwinds.

US coal production

So how has NRP generated an economic profit in this challenging environment?

The royalty business model has attractive features. The owner of mineral interests is not directly exposed to mining operational costs or capex spending. Its own costs tend to be fixed. The lessee bears potential liabilities relating to workers’ compensation and the environment. The mineral interest owner has leverage to a scenario of rising commodity prices and production, but also has downside protection.

Coal mining itself faces challenges which may benefit incumbents at the expense of potential new entrants and additional limit future supply:

· Obtaining financing and insurance is becoming more difficult. To be fair, to date it seems there is more rhetoric than action on this topic, though over time it could have a real impact.

· Approvals to build new mines are becoming more difficult to obtain. For example, the Obama administration issued a moratorium on coal mining on federal land, which was followed by a reversal of the policy under Trump. Last year a federal judge reinstated the moratorium on new leases on federal land.

The quality of the underlying assets is a consideration. Some observations:

· NRP properties yield a relatively high % of metallurgical coal (50% of sales volume in 5Y), which has a less challenging demand outlook compared to thermal coal. The US produced ~61 m short tons of metallurgical coal in 2021, below the 91 m short ton peak of 2011, but nonetheless higher than levels of the mid-2000s. ~75% of US metallurgical coal production is exported to foreign steel makers. Long-term there is some risk that new production technologies (for example being developed by Swedish firm HYBRID) allow steel to be manufactured without coal. For now ‘green steel’ is not cost competitive.

· NRP sales volume has been consistent at above 25 m tons per annum excluding 2020.

· Reserves are ample. Based on 2020 reserve figures, it could support 2022 output for 33 years for metallurgical coal and 60 years for thermal coal.

NRP production of coal

NRP’s associate, Sisecam Wyoming LLC, has generated an average ROIC of 26% since 2014.

Sisecam Wyoming – ROIC

This high level of ROIC is indicative of some competitive advantages, which may include:

· Access to cheap raw materials in producing soda ash. Soda ash can either be produced naturally, through processing trona (~30% of global production), or synthetically, through the Solvay method or other chemical reactions (~70% of global production). Natural producers disclose that their cash costs are ~50% below that of synthetic makers.

· Efficient mining operations – there is no sign that Sisecam Wyoming operates at a disadvantage to peers. Though there are some differences in reporting methods, the 4 major players (Sisecam Wyoming, Genesis Alaki, Solvay, and Tata Chemicals) produce similar EBITDA margins (low-to-mid 20s). The company argues its operations have some advantages, for example being relatively shallow and containing high grade trona.

· Tax advantages – due to the partnership structure the LLC pays no direct tax.

There are perhaps two threats to Sisecam Wyoming’s moat:

· Expansion efforts of competitors. Solvay is expected to complete a 600 k ton expansion at its Green River facility (~20% of Sisecam’s production) in 2024. Pacific Soda has also announced expansion plans.

· New production technologies may allow for synthetically produced soda ash to close the gap with that made from trona. Solvay intends to roll out a new manufacturing process for synthetic soda ash at a site in Dombasle France. However it isn’t clear if the main benefit is merely less carbon emissions as opposed to cost.

Recent NRP initiatives - carbon sequestration and the interest in leasing property to alternative energy producers – are worth pondering. Is it possible for NRP to transition into a play on the energy transition?

Carbon capture & sequestration (CCS) is an industry in infancy. Technology exists to capture carbon in power generation or industrial facilities. It is stored underground in natural reservoirs which have certain geological qualities to ensure leakage does not occur. Probably the major challenge is transportation of the carbon to the storage site – pipelines are the most efficient way to do so but are costly to build.

NRP discloses that it owns 3.5 m acres of subsurface rights, mostly in the southern US, which is suitable for carbon sequestration. In 2022 it signed two agreements for evaluation and potential development. One is with Denbury and relates to a 75,000 acre site in Alabama which may be operational by 2026 and may be joined to an existing pipeline. The second agreement is with Occidental on 65,000 acres in SE Texas. Combined, the two sites can hold 800 m metric tons of carbon.

In addition, it executed a lease to generate solar power in Montana in 1Q 2023. No financial terms were disclosed.

Cyclical trends

The trend is lower for both coal and soda ash prices. Will forgo any bold prediction about the short-term. For now this presents some risk to earnings.

Coal price trends

Soda Ash price trend

Balance sheet health

Leverage

Using March 2023 financials, the major obligations include:

· Debt of $173 m. Of this, $91 m is via a bank credit facility which cost an effective 8.1% in 1Q 2023 (reference rate + 250-450 bps). This facility is available through August 2027. Covenants are comfortably met. The remaining debt is in the form of 6 senior notes, most of which matures December 2026 with ~5% coupon, which is yielding 5.7%.

· Convertible preferred equity of $133 m. Holders are entitled to a 12% distribution. Holders can convert if the common unit price is >$51. NRP has the right to redeem.

· Warrants may be more akin to debt, in that NRP has the right and possible intention to settle in cash. 2.25 m warrants convert at a strike price of $34 and 0.75 m convert at $22.81. The carrying value is $48 m.

Deferred revenue is the only material liability in addition to debt. It arises from lessees making advance payments and lease adjustment payments.

On the asset side of the balance sheet:

· Mineral Rights – carried at cost less accumulated depletion, which is based on units of production method.

· Associate – the Sisecam Wyoming stake is valued using the equity method and carried at $295 m.

· Potential credit losses – stem accounts receivable of $37 m (primarily trade) and long-term contract receivable of $28 m (relating to a financing transaction with a customer). These balances are net of an allowance equal to 7% of the gross balance.

There are no material off-balance sheet items.

Capital allocation

NRP has communicated an intention to pay down more debt and also redeem convertible preferred equity and warrants. Increasing dividends to unitholders is a lesser priority, at least for now.

By year-end 2025 it could be free of debt, preferred equity, and warrants, which could set the stage for a much higher distribution to common unitholders.

Management & corporate governance

NRP is a limited partnership. The general partner is another limited partnership, which has GP Natural Resources Partners LCC as the general partner.

Corbin Robertson Jr is the Chairman and CEO of GP Natural Resources Partners LLC. He has effectively been in control since the IPO. There are 8 other directors, 3 of whom have been on the board for >15 years. The Chairman’s son is also a director. 4 directors are considered independent.

Directors and officers owned 29% of common units as of year-end 2022. The Chairman & CEO’s ownership is 20%. There has been modest net insider buying year-to-date 2023.

Valuation

Since 2017 the units have traded on an average P/TB of 1.6x, in line with the current figure. Looking at the history prior to 2017, the P/TB was typically >3x though this may not have reflected the risk to the coal industry’s structural decline.

There is potentially hidden value in:

· Non-coal mineral rights. Oil & gas rights are carried at just $3 m which compares to average annual royalties of $7 m in 5Y. Construction aggregate interests are carried at $5m versus $3 m in average annual royalties.

· The stake in Sisecam Wyoming – the recent privatization of Sisecam Resources provides some indication of the value of NRP’s associate. Sisecam Resources traded under the SIRE ticker until it was privatized in May 2023. It owned 51% of Sisecam Wyoming and had no other source of revenue. The transaction multiple was 4.9x EV/EBITDA. This values Sisecam Wyoming at an EV of $809 m. The implied value of NRP’s stake is $344 m, an unrealized gain of $49 m.

· Land holdings – all land was purchased prior to 2007. Marking this higher by 30%, which doesn’t seem aggressive given price trends for agriculture/residential land, yields a gain of $7 m.

Potential hidden value

As for carbon sequestration rights, heroic top-down assumptions about acres leased, the volume of carbon sequestered, and the price per ton, could lead to an enormous figure. In the 3Q 2022 earnings call, NRP management suggested investors assume $2 per metric ton as income. This would be $1.6 b in income for the two sites (combined 800 m tons of capacity) assuming full capacity! NRP would still have >3 m acres to lease in similar transactions. However, there are lots of operational and policy issues which could cause these projects to falter. For now, it may be best to simply view this as a free option.

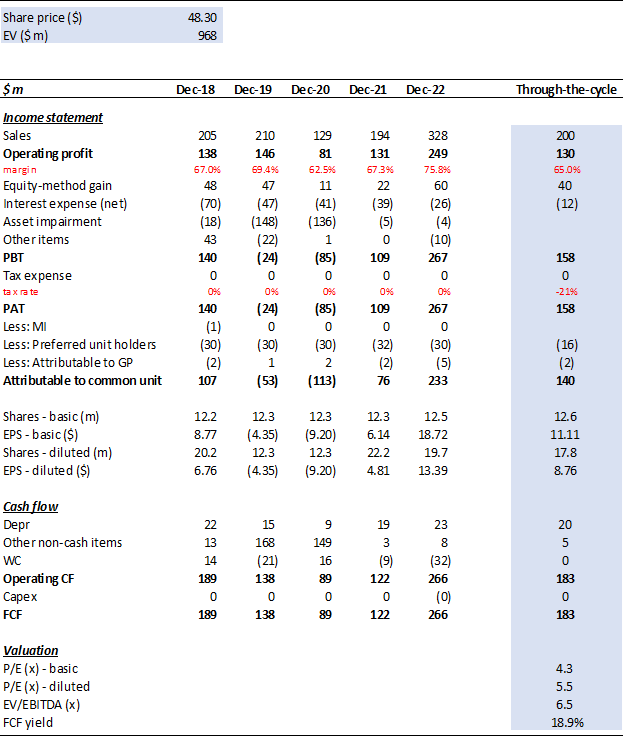

2022 earnings and free cash flow are probably not sustainable. A through-the-cycle diluted EPS may be $8.76, to which the shares trade on 5.5x. Free cash flow yield may be 19%. As this is a limited partnership, investors are likely to be taxed on their share of earnings. The figures quoted should therefore be seen pre-tax.

NRP through-the-cycle earnings

Disclosure: The author of this report does not own shares in Natural Resource Partners though may purchase the shares in the future.

Disclaimer: The information contained in this report is for general informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities or other financial products. The opinions expressed in this report are those of the publisher and are subject to change without notice. Readers are advised to conduct their own research. The publisher does not guarantee the accuracy, completeness, or reliability of any information in this report, and disclaims any liability for any losses or damages arising from the contents of the report.