Recent investors in Janus International, a product and service provider to the self-storage industry, may feel like mistakenly optimistic auction winners from the Storage Wars reality series. Janus shares sit 51% below the February high after disappointing June and September results. However, these units are not devoid of value. Janus is the market leader with at least a moderate moat around its business. The cyclical downturn is an opportunity to acquire shares.

Ticker: JBI

Share Price: $7.83

Market Cap: $1,105 million

History

Janus was founded in 2002 in Georgia as a manufacturer of self-storage doors.

In 2013 Saw Mill Capital, a private equity firm, acquired Janus. In 2018 it sold Janus to another private equity firm, Clearlake Capital. The next year, Janus’ founder & CEO retired.

In June 2021, through a business combination accounted for as a reverse recapitalization with a SPAC (Juniper Industrial Holdings, controlled by ex-Honeywell executives), Janus became a listed company on the NYSE.

In August 2021 Janus acquired DBCI for $169 million, recognizing goodwill and intangibles of $150 million. The Janus CEO later explained that this had been its largest competitor.

Janus benefited from healthy demand from the self-storage industry in 2022 and 2023. Conditions have since weakened.

In mid-2024 it acquired Smith TMC and related companies, which primarily services the trucking industry, for $60 million. It recognized $57 million in goodwill and intangibles.

Operations

From its inception as a manufacturer of self-storage doors, Janus has expanded to adjacent products, including door operating systems, hallway kickplates, commercial sheet doors, mass relocatable storage units, and smart entry systems. It has also repositioned itself from being a ‘products company’ into a ‘solutions provider’.

Janus explains that institutions often come to it with a project proposal – they own a plot of land and want to turn it into a self-storage facility. Janus does much of the planning, design, and interior unit mix. This is a ‘free’ service which then leads to it being heavily involved in the project.

There are three sales channels:

· New Construction of self-storage (37% of 2023 revenue).

· Restore, Rebuild, Replace (‘R3’) of self-storage (31%). This includes the expansion of existing facilities, projects in which former big box retail space is turned into self-storage units, and redesign of a site’s interior layout.

· Commercial & Other (32%). E-commerce warehouses and logistics spaces are major markets, but its products are also used in schools, residential units, etc.

Services, primarily installation, accounted for 12% of revenue in 2023.

Noke, a trademarked smart entry system with ~350k installations, probably accounts for a small % of revenue (in the 4Q 2021 earnings call management put revenue contribution at 2%).

The two formal business segments may be of less useful in understanding the business. North America is 93% of revenue, International 7%.

The customer base is diversified, with the top 10 accounting for <15% of revenue.

It has 10 domestic manufacturing sites and 3 international facilities (Australia, Poland, and the UK).

In Self-Storage, most sales stem from direct client relationships, whereas in Commercial sales are via dealers and distributors.

Business Quality

The track record period is short (from 2020) but healthy. Average ROIC has been 14%. Gross margin has ranged from 34% to 42%.

Why the strong returns? Some observations:

· The nature of the business supports pricing power. Customized orders are normal. Janus is integrated into customers’ planning process for both new construction and R3 projects. Janus provides a crucial ‘last step’ without which store owners cannot begin to operate, and the cost of its products & services is relatively small (~10%) compared to the overall project. This is very different from the typical building products company which is bidding for business from a general contractor looking for the lowest supplier.

· Capex is limited to ~2% of sales.

· Management argues it has superior lead times which generate customer loyalty.

· The size of its business makes it a major customer for steel coil distributors, which may give it some bargaining power for its largest material.

What about competition? There isn’t a great deal of transparency about this, as most competitors are either private or small parts of large businesses. Janus management has in the past noted it has a market share of >50% but doesn’t specifically mention peers in any of its disclosure. All indications are that major competitors are small. Specifics:

· MakoRabco – specializes in design, supply, and installation of self-storage facilities. It is majority-owned by New State Capital Partners (NSCP). In 2019 the PE firm acquired Mako Steel, and then in 2021 it acquired Rabco Enterprises and merged the two businesses. NSCP did not release any financial terms of these deals. One clue is that NSCP claims to seek investment in firms with EBITDA of $8-30 million. If we assume these two investments were on the high side of this range, and a bit of growth post-acquisition, it suggests EBITDA of ~$80 million. This is small compared to Janus’ EBITDA of $294 million in 2023. Another clue is from the employee data – Linkedin puts total employees in the 51-200 range. Once again, this is small compared to the Janus figure of 1,864 employees.

· Overhead Door Corporation. This is a Texas-based company acquired by Japan’s Sanwa Holdings in the 1990s. It has a broader product offering compared to Janus, in that it does garage doors for residential in addition to commercial doors (including self-storage). Sanwa Holdings reports North America revenue of $1.5 billion. Given the broad nature of the business, it would seem self-storage doors are at most 10-15% of this, making a small player relative to Janus.

· CHI Overhead Doors. This is also a broader business than that of Janus, in that it supplies both residential and commercial markets. In 2022 Nucor acquired it from KKR. The terms of the transaction put the company’s EBITDA at $230 million. This is not far from that of Janus, though once again, it would seem self-storage doors may be just 10-15% of this figure.

Recent Trends

Results for 2Q and 3Q were generally weaker than street expectations. Both quarters prompted the company to revise lower full-year guidance for revenue and adjusted EBITDA. Guidance for revenue now sits at $910-925 million (from ~$1.1 billion initially). For adjusted EBITDA the current guidance is for $195-205 million (from $286-310 million). 9M 2024 revenue is -9% YoY, operating profit -26%.

Janus management attributes weak performance to project delays, primarily due to concerns about interest rates, with the November elections a possible secondary factor. Whatever the reason, macro data supports the view that the self-storage industry has curtailed investment.

Outlook & Opportunities

Self-storage operator investment spending has turned negative and for now, there are no signs of improvement. Is industry saturation not a risk?

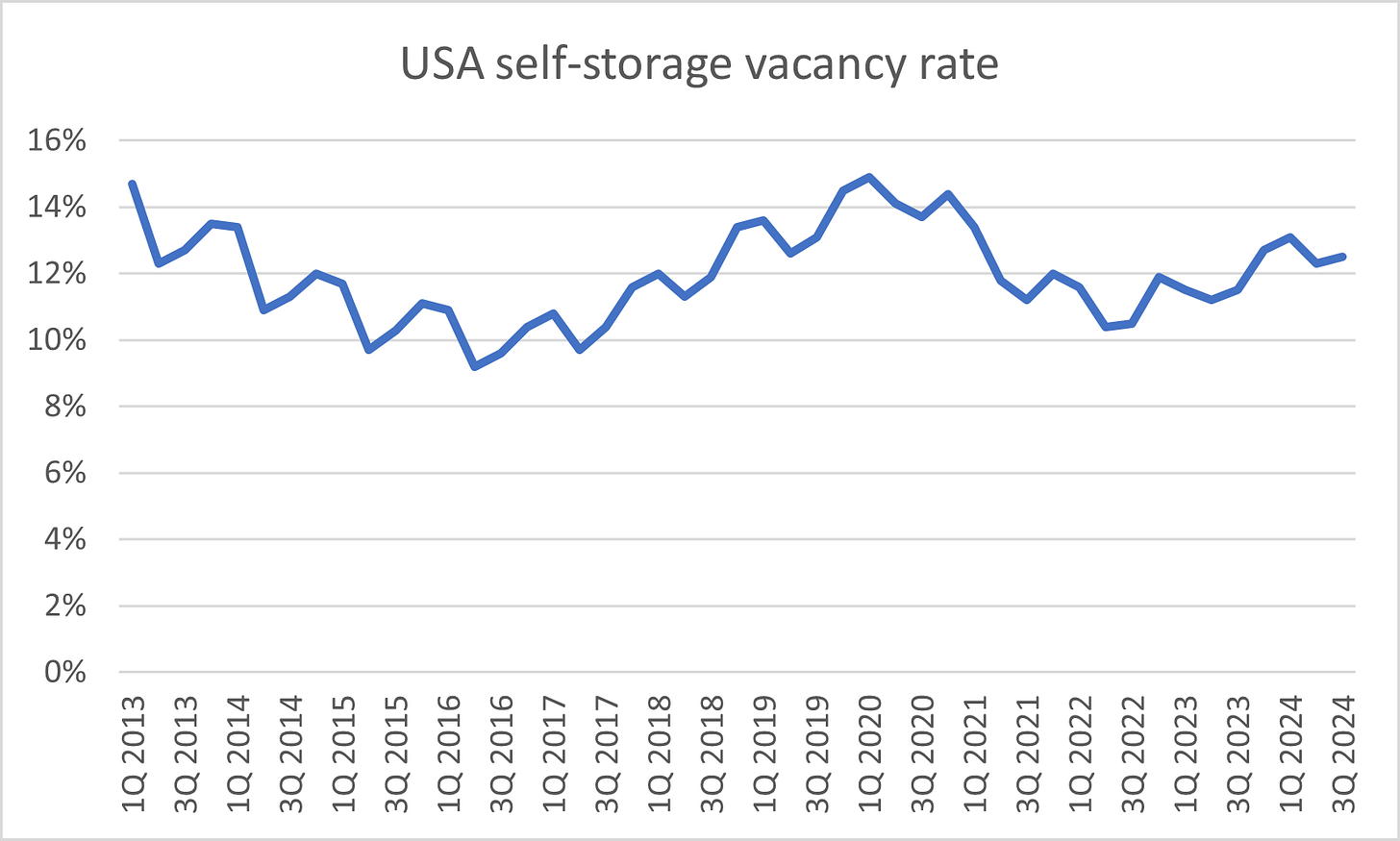

Vacancy rates don’t give any indication of saturation. The most recent figure of 12.5% is close to the recent historical average of 12.0%.

New construction isn’t the only driver for Janus. What it terms ‘R3’ is a major opportunity. ~60% of existing units are >20Y old. Most are not climate controlled and do not have ‘smart’ entry / security systems. Janus earns the same margin in R3 as new construction so this an attractive opportunity.

In Commercial, it can grow with the economy. Over time there may be opportunities to have direct client relationships, which would support margins.

Noke deserves special consideration. For self-storage operators, labor is one of the largest costs. Moving to a smart entry/security system can reduce the need for labor dramatically. The Janus CFO estimates the typical payback for an investment in Noke is <1Y. There are ~25 million individual units in the US – at $250 per installation, this would be a major boost to earnings with a recurring component from servicing.

International opportunities are interesting. A report from Nuveen shows that on a per capita basis, European self-storage capacity is <10% of that of the US. Surveys show large chunks of Europeans have never heard of ‘self-storage’. Sure, Europeans probably don’t own as much junk as Americans, but one wonders if interest in self-storage won’t increase over time. Development of this market would not only drive revenue but would allow Janus to improve scale, ending the dilution to margin caused by International (operating margin of 9% versus 23% for North America).

Balance Sheet Health

The balance sheet is flimsy. Net tangible equity is negative. Most debt relates to a senior secured term loan at a price of 7.75% due in 2030. S&P’s rates the debt BB-. Leverage looks OK at 2.1x net debt/EBITDA. It has a $125 m revolving credit line.

Accounts Receivable are 30% of net worth. Janus was stung with a customer bankruptcy in 3Q resulting in an $8 m impairment. Days Outstanding have crept higher to 61 days as of 3Q from <50 days a few quarters ago.

Capital Allocation

Janus has repeatedly stressed an interest in M&A. Its interest is in moving to adjacent products and services, for example self-storage interiors, warehousing systems, commercial & loading docks, exterior doors, and technology.

In early 2024 it announced a $100 million buyback program. Through September it had repurchased shares worth $60 million.

Management & Corporate Governance

The usual institutions are significant shareholders (3-10% apiece). Insiders own 7% of the company, including 2.7 million by the Chairman and 1.1 million by the CEO. Insiders have not been net buyers following the stock’s stumble in recent months – the obvious interpretation is that a turnaround may take some time.

There are 10 directors on the board, including the CEO and 9 independent and non-executives. Director backgrounds include private equity, self-storage, and industry.

In the last year there have been no changes to the 9-person executive team. Several executives, including the CEO, have been with the company >20 years.

The CEO earned $4.8 million and CFO $1.9 million in 2023. Adjusted EBITDA is the sole driver of executive incentives. The good news – no DEI component. The bad news – no direct link to shareholder returns.

Valuation

It is difficult to put a firm number on what the shares may be worth. The stock has a short trading history, so looking at previous cycles isn’t possible. Tangible book is negative, so the balance sheet doesn’t provide much of an anchor. Earnings and cash flow are currently under pressure.

A peer group of 19 industrial companies (the same group used by compensation consultants) currently trade on median 17x EV/EBITDA and 29x earnings using trailing figures. Janus, at 6x and 10x, looks attractive.

FCF yield using 2024 guestimates is 7%.

The reasonable optimistic scenario is that Janus maintains its grip on the core business, which resumes growth. It can add incremental revenue from Noke, adjacent products, and International. Earnings compound and the multiple re-rates.

Disclaimer: The information contained in this report is for general informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities or other financial products. The opinions expressed in this report are those of the publisher and are subject to change without notice. Readers are advised to conduct their own research. The publisher does not guarantee the accuracy, completeness, or reliability of any information in this report, and disclaims any liability for any losses or damages arising from the contents of this report. The publisher of the report often invests in companies about which it writes.

Thanks a lot for sharing -- this is very informative.

A minor suggestion -- for self-storage vacancy rate and mini-storage construction spending, maybe add source for the data just so people can trace them to the source and verify for themselves. Anyways, thanks again.