Hong Kong stocks too cheap to ignore (part 2)

Great Eagle Holdings - unloved global hotel operator

Great Eagle (41 HK) shares have undergone an enormous de-rating. Have a look.

The shares now sit at 0.16x tangible book value and offer a 7.3% dividend yield. Leverage is sensible with net debt-equity at 40%. Another ‘uninvestable’ Hong Kong stock?

The derating is all the more stunning considering the robust performance from Hotel stocks, the industry which represents the majority of Great Eagle’s revenue. In the last 5Y, while Great Eagle investors have nursed a 52% loss, Marriott shares have returned +81%, Hilton +124%, and Accor +21%.

‘OK so it is cheap but are there any catalysts?’ Quite possibly:

· The Hong Kong residential property market may have bottomed out in February. The primary driver is an end to counter-cyclical measures. Improved affordability (currently the best since 2017) also helps.

· Great Eagle’s hotels and shopping mall will continue to benefit from cyclical recovery.

· Eventually the Hong Kong office market will bottom out, perhaps in 2025, which is relevant for an investor with a 2-3 year horizon.

Some background

Great Eagle is a well-established Hong Kong business group focused on hotels and property investment.

It was founded in 1963 and listed on the exchange in 1972. In the 1980s it added Three Garden Road (formerly Citibank Plaza) to its investment portfolio. In the mid-1990s, with the handover to China looming, it diversified (hedged?) into overseas hotels.

The Langham Place development in Hong Kong’s Mongkok district was completed in 2004, at a total investment cost of ~HKD 10 b. Great Eagle’s interest coverage slipped to 1.2x in 2005. Financial stress may have prompted the spin-off of two major assets, Three Garden Road and Langham Place, into Champion REIT in 2006. Great Eagle maintained a 49% stake.

For the next several years there were no major changes in the group’s asset portfolio. The ownership in Champion REIT crept higher, prompting a reclassification to an associate (from AFS investment) in 2010 and to consolidation in 2013. Langham Hospitality, which holds 3 Hong Kong hotels, was separately listed in 2013 but Great Eagle maintained a majority stake and continued to consolidate the business.

The dumpster fire of Hong Kong’s economy from 2019-2022, caused by political protests, the draconian response to Covid, and a weaker China, led to consecutive net losses from 2019-2022. Net losses were due primarily to FV losses on investment property, a non-cash item.

Operations

There are four pieces to the business:

· Hotel operations are 61% of revenue. It owns and operates ~15 hotels, most of which are 5-star. By geography revenue is diversified at 42% North America, 25% Hong Kong, 13% Australia/NZ, 11% Europe, 7% China, 3% other (including management fees). Great Eagle owns the Hong Kong hotels via the 72%-owned Langham Hospitality.

· Investment property is 23% of revenue. This mix is 66% office, 30% shopping mall, and 4% other. 99% of the portfolio is in Hong Kong, with the remaining amount in the US and China. ~93% of the rent base is captured through 70%-owned Champion REIT. One asset, Three Garden Road, is 49% of rent.

· Property development – there are several projects that fall under this heading. From a balance sheet perspective, the largest is a residential project at Ho Man Tin, Kowloon which is carried at HKD 9.9 b and currently being presold, with construction set to finish in 2025. In the Held-for-Sale category, at HKD 1.6 b, are the remaining units of development at Tai Po. Other development projects include hotel development / redevelopment (including Venice and Tokyo), which are carried at HKD 1.5 b.

· Other – accounting for 6% of group revenue are sundry operations in trading of building materials, property management services, etc.

2023 revenue mix

Business quality

Since 2005, the year in which investment properties have been measured at FVTPL, Great Eagle’s average ROE has been 8%. There have been some good periods, 2005-2007 (24% ROE) and 2010-2018 (9% ROE), and some lousy ones (2019-2023, during which average ROE was negative 3%).

ROE trends can largely be explained by the balance sheet features - Great Eagle is an asset heavy business which avoids excessive leverage. In addition, the accounting for investment properties, in which FV gains/losses flow through the P&L, amplifies economic conditions.

There are no barriers to entry into any of Great Eagle’s businesses. Access to financing and permits are all that stand between a prospective developer and a new hotel or office tower.

So how should we think about the quality of the business and assets?

Start with the Hotel segment. Great Eagle owns its hotel assets. Most hotel operators eschew this model of asset ownership as being too capital intensive. So comparing Great Eagle’s hotel segment with operators such as Marriott and InterContinental, both of which post ROIC of >30% in good years, is apples-to-oranges.

But Great Eagle does fare well in comparison with operators which predominately own or lease their hotels.

The Hotel segment KPIs have been healthy. Using a simple average of individual assets, occupancy was 75% in 2023, close to the 77% of 2018. To put this in perspective, in 2023 Marriott’s occupancy was 69% and Hilton’s 72%. Revenue per available room (RevPAR) has fared well compared to the largest global operators over the pre-covid to post-covid period. For Great Eagle’s international hotels, the weighted average RevPAR has increased 7% compared to 6% Marriott and 2% Hilton. Great Eagle’s HK hotels posted a lower RevPAR during the period, but Hong Kong wasn’t fully reopened until 2Q 2023.

Next, let’s think about the quality of investment properties.

Three Garden Road, 49% of investment property income, seems a legit Grade A office tower, especially to anyone who has visited it. Lots of guys and gals, all dressed for success, scurrying about. However financial performance has lagged by most measures. The 17% vacancy rate as of 2023 was high by industry standards. Since 2009 average rents are little changed compared to a 46% increase in the overall HK market. It lost an important tenant in 2014. So what’s the problem? Location is a bit off – it is really on the outskirts of Central. It was completed in 1992, so is dated compared to some major buildings. It does not sit above an MTR station or large shopping mall, also reducing the appeal.

Langham Place Shopping Mall, 30% of investment property income, is a shopping mall located in Mongkok, a densely populated area in Kowloon. The mall caters to the mass market – think Uniqlo not Prada. Plus a movie theatre, grocery store, etc, etc – it has it all. The mall has performed well against all metrics. Since 2009 the average rent has more than doubled, easily beating the overall HK figure. Occupancy has been at or near 100% for more than a decade. Overall it looks to be a quality asset that will generate revenue at least in line with retail spending.

Langham Office (14% of investment property income), also in Mongkok, doesn’t capture the banking and asset management crowd, which is probably a good thing. Its tenants operate more mundane businesses (healthcare & medical, beauty, and fitness center occupy 74% of space). Since 2009 the CAGR of rent has been 4% and occupancy >90% in most years.

Some remaining properties account for 7% of investment property income, primarily the Great Eagle Centre, serviced apartments, and others.

Outlook

The hotel industry is cyclical. For now, all looks OK. Some comments from the frontline:

· Marriott reported YoY RevPAR growth of 4% in March 2024 and guides for 3-5% for the year.

· Accor reported YoY RevPAR growth of 8% in March 2024 and guided for RevPAR CAGR of 3-4% from 2023-2027.

· Hilton reported YoY RevPAR growth of 2% in March 2024 and guided for 2-4% growth for full-year 2024.

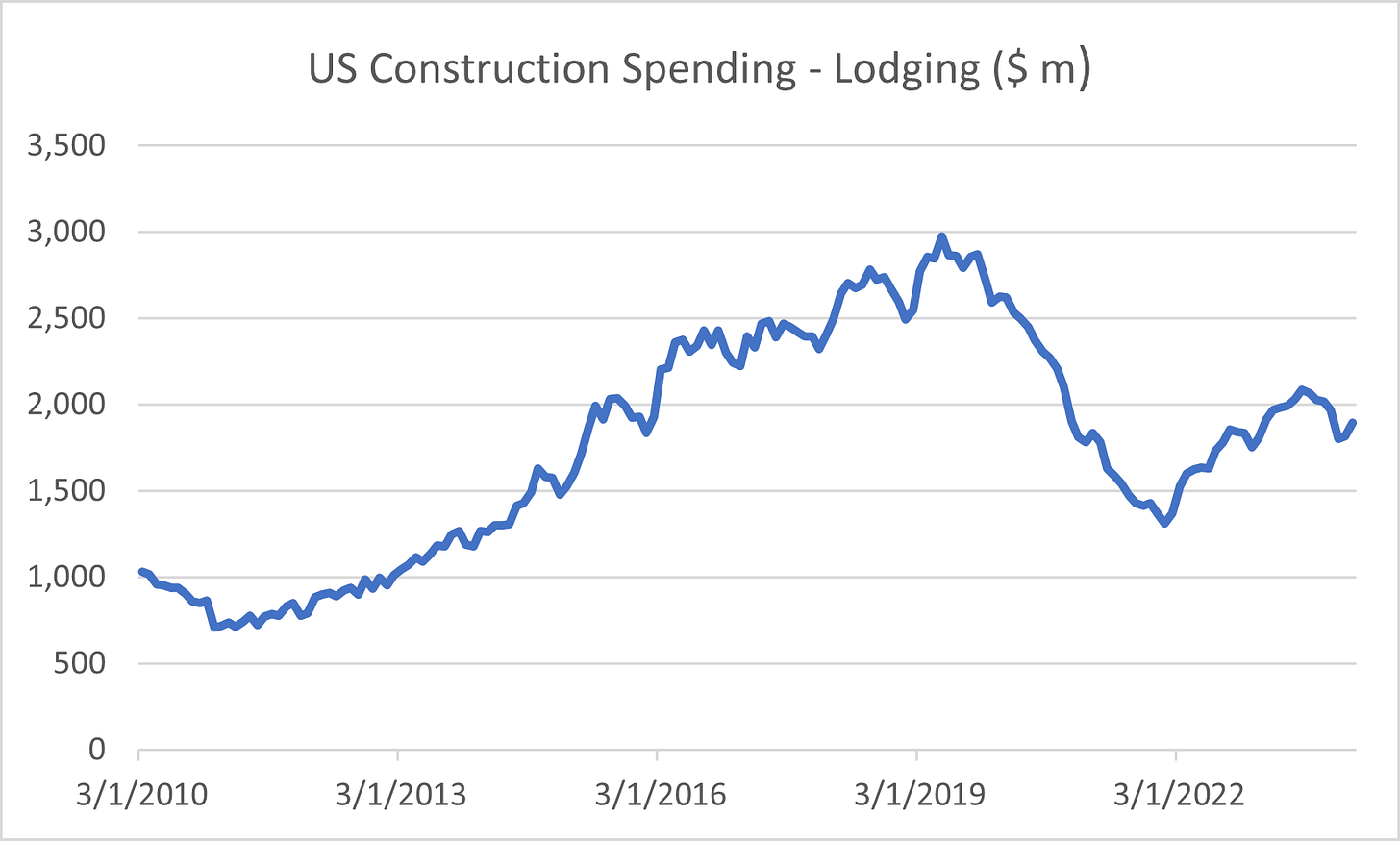

With travel flow strong, a threat would a surge of new hotel development. Given the rise in financing costs, that seems unlikely for now. Data from the US, which is Great Eagle’s largest market in Hotels, supports this view. Hotel investment bounced as the pandemic waned but remains well below pre-Covid levels.

Hong Kong office rents reached a new low in February. Most commentators suggest another 5-10% decline in rents in 2024. Three Garden Road looks exposed, with 17% vacancy rate and 19% of leases maturing in 2024 and another 43% in 2025. But keep it in perspective, it is 12% of group revenue and only 70% owned.

The outlook for shopping mall property is more favorable. Rents bottomed out in April 2022. ~1/3 of leases expire in 2024 at Langham Mall.

The final piece of the business is property development. The main issue is the outlook for Hong Kong residential property. The structural set-up is healthy, as just over 50% of residents own their home, a low figure for an affluent region. Affordability is the historical obstacle to home ownership and affordability in 2021 was the lowest in more than 20 years. Things may be changing, though. In February the authorities announced an end to the counter-cyclical measures (Special Stamp Duty, Buyer’s Stamp Duty, etc) that had been in place for years. Affordability is the best since 2017. There are signs these measures are having some positive impact. Property transactions surged in April, which will reduce concerns about unsold apartment inventories.

Financial leverage

Great Eagle has maintained its conservative financial position. Perhaps one miscalculation on its part was not taking advantage of the ultra-low interest rates of 2-3 years ago to lock in LT funding. So its debt maturity profile, as of 2023, stands at 53% <1Y, 6% 1-2Y, 34% 2-3Y, 7% >5Y. Its cost of debt may reprice towards 6% from 4.5% last year.

Management & corporate governance

Great Eagle is old school Asian when it comes to board composition. This is not meant as a complement. There is a lot not to like:

· There are too many directors – 15 in total.

· 7 directors are from the Lo family, including the Chairman and MD, his mother, 3 brothers, a sister, and a son. In addition to the Chairman, 2 are considered Executive and 3 are considered Non-Executive. A special shout-out goes to the Chairman’s mother, aged 104, clinging to her board seat despite refusing to attend board meetings, the AGM, or participate in ‘continuous professional development’.

· 5 directors are listed as ‘independent and non-executive’. Of these, one joined the board in 1995 and another in 2002, i.e., they aren’t really independent.

On top of this, the press has documented a family squabble, complete with court cases. With all that money you’d think they would be happy…

This noted, public shareholders have generally been treated fairly. There have been no abusive related party transactions or dimwitted strategic moves.

The Executive Chairman is 77 years old, and it is fair to question what comes next. His son (Alexander Lo) has been an Executive Director since 2005 and has some work experience outside of the family business. But at only 38 he may not be ready.

Conclusion

Great Eagle shares offer tremendous value. There are tentative signs that the residential property market is recovering, which, if sustained, could reignite Hong Kong’s animal spirits. A return to more normal multiples (15x EV/EBITDA, 0.4x P/TB) could see a re-rating to HKD 29 / share.

Disclaimer: The information contained in this report is for general informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities or other financial products. The opinions expressed in this report are those of the publisher and are subject to change without notice. Readers are advised to conduct their own research. The publisher does not guarantee the accuracy, completeness, or reliability of any information in this report, and disclaims any liability for any losses or damages arising from the contents of the report. The publisher of the report often invests in companies about which it writes.

thanks , comprehensive articulate writing is time consuming. much appreciated