Civeo (CVEO)

15% FCF yield, share repurchases likely, would benefit from turn in commodity prices

Civeo Corp (CVEO) - $19.36

July 3, 2023

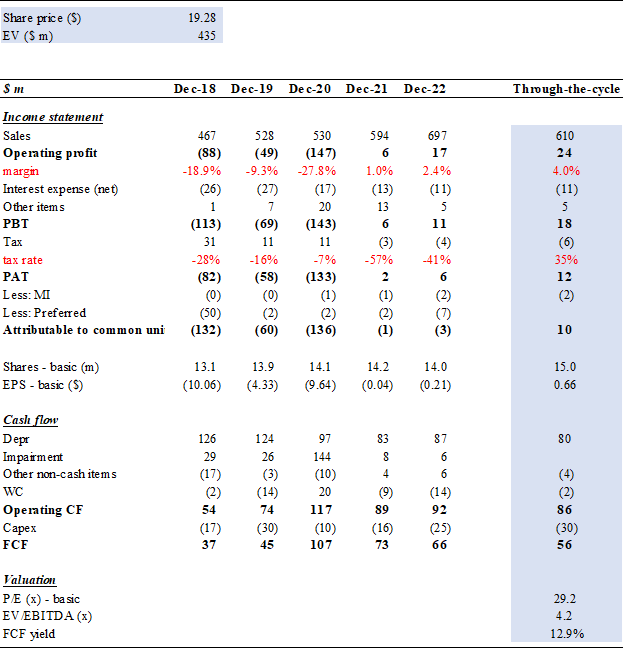

Civeo shares are 47% lower after reaching a multi-year high in February. Expected weak 2023 results have been discounted. Civeo’s earnings consistently underwhelm, in part due to an overly conservative depreciation charge, but the track record for free cash flow is solid. The shares trade on a 15% FCF yield and with lower leverage, there is plenty of scope for buybacks. A turn in commodity prices would be a major catalyst for the share price.

History

Oil States spun-off Civeo as a workforce accommodations specialist in May 2014. The business had been operating in Canada since the late 1970s and expanded to Australia via acquisition in 2010. At the time of the spin-off Civeo operated ~23,000 rooms, additional capacity via mobile camps, and owned 3 manufacturing facilities producing portable modular buildings, primarily for own use.

The timing of the spin-off was far from fortuitous as key commodity prices (oil, iron ore, metallurgical coal) began a slide that lasted until early 2016. Civeo paid two quarterly dividends before suspending further payouts and pivoting to cost cutting. The stock declined ~50% in one trading session in September 2014 when it announced an intention to not convert to a REIT, in addition to providing weak guidance. Activist investors attacked but with little success. The stock eventually bottomed in early 2016 after a >90% drop following the spin-off.

Revenue contracted through 2017. Occupancy was 61% that year compared to 93% in 2014. Despite net losses, it generated FCF and reduced debt during the cyclical downturn.

In 2018 it acquired Noralta Lodge, which had a portfolio of 11 lodges and 7,900 rooms in Alberta Canada. The consideration was $340 m, 0.7x sales. Civeo recognized $235 m of intangibles. The transaction was settled with a mix of common shares, preferred equity, and cash.

The early months of the Covid-19 pandemic were challenging though the company benefitted from the recovery in commodity markets from the 2H 2020.

In 2022 it disclosed that the McClelland Lake Lodge land lease, set to expire in June 2023, would not be renewed. This lodge has recently produced ~6% of group revenue. The shares lost 30% in two trading sessions ending March 1, 2023, after weak guidance for 2023.

Operations

Civeo develops, owns, and operates what are sometimes referred to as ‘man camps’, i.e. workforce accommodation for natural resource companies operating in remote locations. A quick summary of operations:

· Services offered – lodging, food service, housekeeping, and maintenance are the basics. Additional services are laundry, facility management, wastewater treatment, power generation – essentially anything that is required in these outposts.

· Locations – it primarily operates in Canada (57% of revenue) followed by Australia (40%) and the US (3%). In Canada it has 16 lodges, of which 15 are in Oil Sands region and 1 in British Columbia which serves development of an LNG terminal. In Australia there are 8 ‘villages’, of which 7 are focused on coal mining, specifically metallurgical coal (used in steelmaking). The remaining village is based around LNG and iron ore. In the US it operates 2 lodges, 1 in the Bakken shale region and 1 serving downstream oil & gas activities in Louisiana. In the 3 geographies it has ~28,300 rooms. It also has a fleet of mobile assets in Canada which are deployed for shorter projects. In some instances it handles operations of customer-owned facilities.

· Customers – are typically large natural resources production companies, including Conoco Philips, Suncor, and Stanmore Coal.

· Contracts with customers – typically take-or-pay or exclusive arrangements, in some instances with minimum occupancy requirements. Multi-year contracts include annual adjustments to cover cost inflation.

Business quality

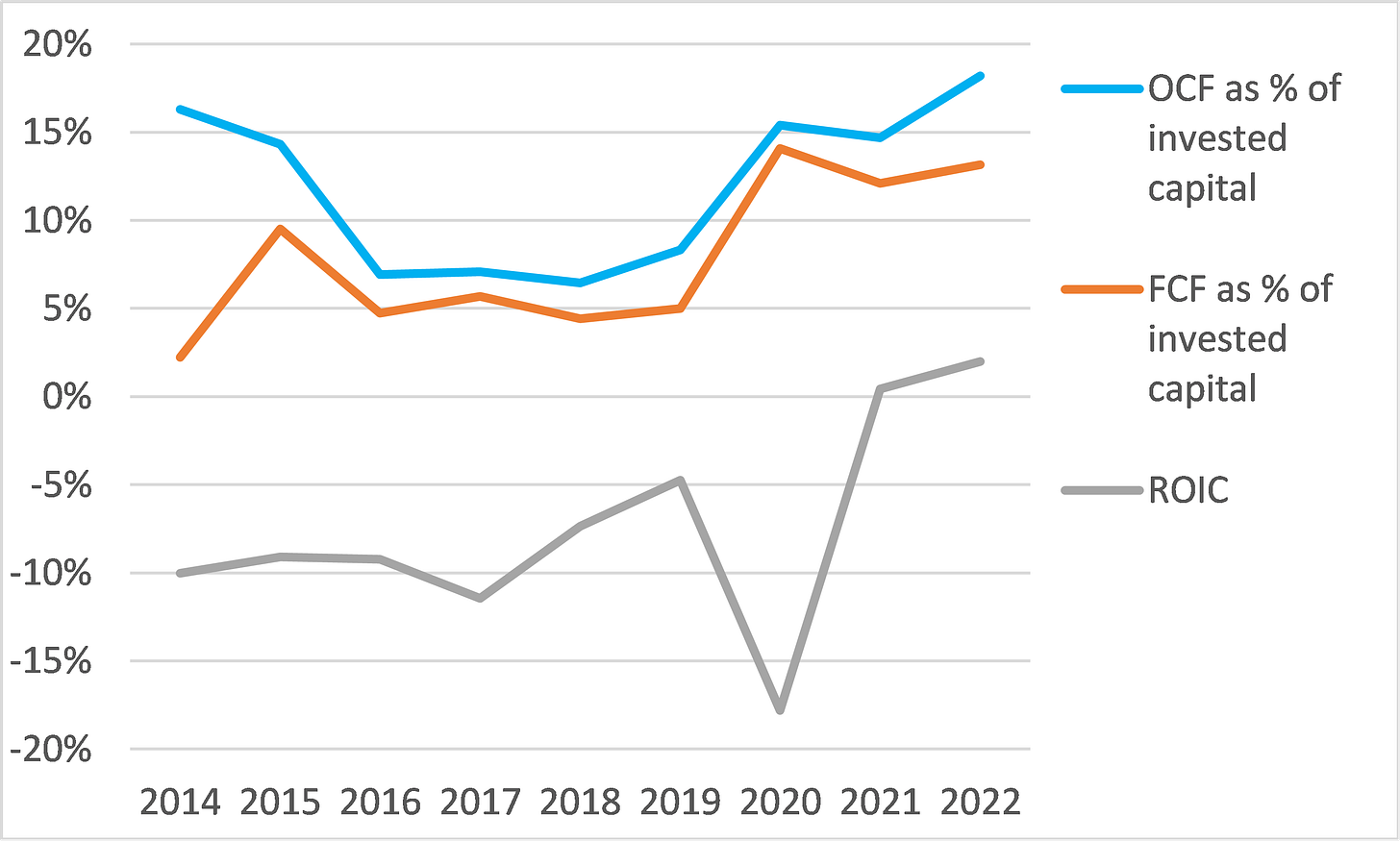

Since the IPO the average ROIC has been negative 7% - suggestive of a low quality business. One issue is the depreciation policy, which looks too conservative (more on this topic later!). Comparing operating cash flow and free cash to invested capital yields a more attractive portrait of Civeo.

The process of acquiring land, obtaining permits, and completing construction is lengthy. But there are no real barriers to entry in the workforce accommodation industry.

As with any real estate business, location and capacity can be competitive advantages. In the Canadian oil sands Civeo’s >18,000 rooms are ~50% of the industry capacity (excluding in-house accommodations provided by employers). In the Bowen Basin region of NE Australia, it operates ~2/3s of industry capacity.

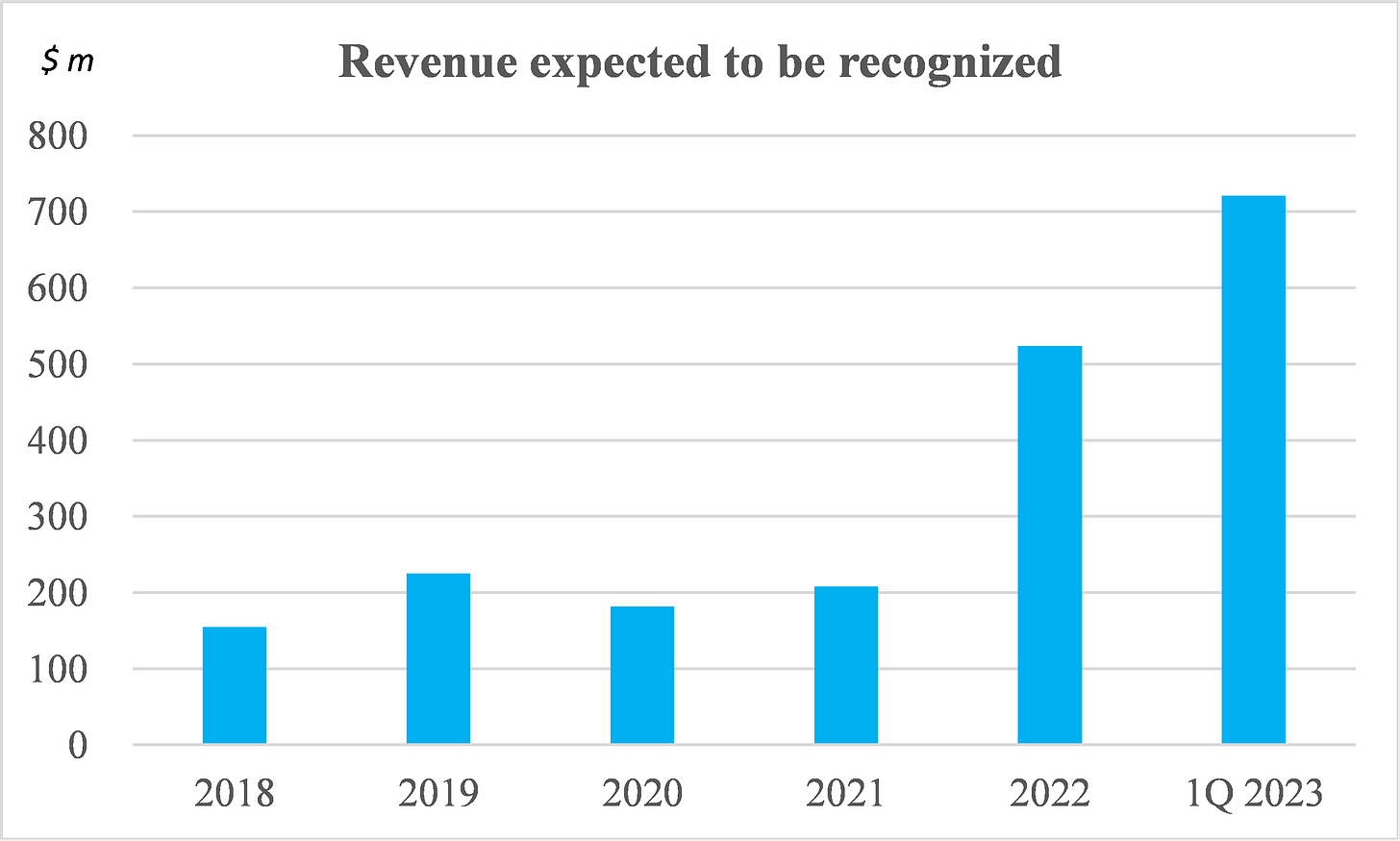

Customer relationships and LT contracts provide recurring revenue - an attractive feature. As of March 2023 Civeo has $721 m of ‘revenue expected to be recognized’ over several years in line with LT contracts. This figure has trended higher.

The US market has been a detractor of overall performance. EBITDA in this geography has been negative annually, with the exception of 2018. The US business may have been held back by a limited footprint. Civeo has focused on the Canadian and Australian markets, where it saw opportunities for higher returns. This drag will ease as the US market is now an immaterial portion of revenue and the remaining assets will likely be sold.

The business is exposed to FX rates and commodity prices. Forex translation risk is not hedged. In 2022, C$ and A$ deprecation caused revenue to decline by $38 m and EBITDA by $8 m. Both currencies have been relatively weak against the $ in the past several years.

Cyclical trends

Civeo has presented cautious guidance about 2023 results, expecting revenue to contract 7-10% and EBITDA to decline 13-22%. A major factor is lost revenue from mobile camps, which had been servicing the construction of the Coastal GasLink Pipeline in British Columbia.

Sagging prices of crude oil and coking coal are potential threats.

Balance sheet health

Net debt is low versus history at 1.5x of EBITDA as of 1Q 2023. The debt is floating rate, priced 200-400 bps over benchmark, primarily in the form of a revolving credit facility that expires in 2025. Effective cost of debt was 7.9% in 1Q 2023 compared to 5.5% for full-year 2022.

Accounts receivable are 42% of net worth. Historically credit losses have been immaterial, owing to the high-quality customer base.

Capital allocation

Management wants to maintain leverage near current levels. As such, returning cash to shareholders is a likely priority. From late 2021 to present it has repurchased 884k shares though the share count has expanded due to the conversion of preferred equity (issued to Noralta shareholders) to common. The August 2022 board authorization allows for another ~516k shares to be repurchased (3.4% of outstanding). Using the company FCF guidance for 2023 ($43-58 m) it would be able to repurchase 15-20% of outstanding shares in 2023, assuming all cash is used for buy-backs.

Management & corporate governance

There are some significant holders of the stock. Horizon Kinetics, an investment advisor, owns 27%. The Torgerson Family Trust, which is linked to the founder of Noralta Lodge, owns 8%. Several institutions have meaningful stakes.

8 of 9 directors are Independent and have relevant backgrounds.

Directors and executive officers own 3.4% of outstanding shares as of March 2023, of which the CEO owns 1.3%.

The CEO earned $4.7 m in 2022 and 3 other senior execs $1.1-1.6 m. Annual variable compensation is driven by ‘adjusted’ operating cash flow (80%) and safety performance (20%), with geographic heads also measured on division EBITDA. Long-term variable remuneration considers the 3Y relative total shareholder return and cumulative free cash flow.

Valuation

Free cash flow yield (12M ending March 2023) is attractive at 15%. Despite years of net losses, Civeo has been a reliable producer of free cash flow. On a ‘through-the-cycle’ basis, free cash flow yield may be 13%.

Another consideration is the value of the core operating assets in light of what is potentially an overly conservative depreciation policy. One clue is the track record relating to asset disposals. Taking the cumulative figure starting in 2014 through 1Q 2023, Civeo has recorded $30 m of disposal gains on $81 m of disposal proceeds, implying these assets were carried at $51 m. Stated another way, the market value was 160% greater than the carrying value. The aggregate figures are not distorted by any single transaction. Instead, Civeo has consistently booked gains on asset sales.

Poor earnings yet strong cash flow, combined with market clearing values for assets more than double the carrying value, are all signs that the deprecation is overly conservative. Consider the following:

· Civeo uses a 3-15 year useful life range for its ‘accommodation assets’, which account for 93% of gross PP&E (excluding land). Depreciation is straight line ‘after allowing for salvage value where applicable’. This implies some residual value is recognized, though with net PP&E just 17% of gross (excluding land) it would seem any such figure is immaterial.

· McGrath RentCorp, which rents modular buildings not dissimilar from the structures utilized by Civeo, employs a far less conservative policy. It depreciates its modular buildings over 18 years and assumes a 50% residual value.

· Black Diamond Group is also far less conservative. For its workforce accommodation rentals, it employs a 10% declining balance depreciation method with 10% residual value. This equates to a ~22-year useful life. In other disclosure, it explains the ‘practical asset life is 30+ years’.

· Dexterra, like Civeo, uses a 15-year useful life for camp facilities though explicitly assumes a 20% residual value.

The asset base surely seems able to support revenue generation.

Disclosure: The author of this report does not own shares in Civeo Corp though may purchase the shares in the future.

Disclaimer: The information contained in this report is for general informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities or other financial products. The opinions expressed in this report are those of the publisher and are subject to change without notice. Readers are advised to conduct their own research. The publisher does not guarantee the accuracy, completeness, or reliability of any information in this report, and disclaims any liability for any losses or damages arising from the contents of the report.

what is the current situation and valuation ?