The Fed hiking cycle hasn’t dented the performance of homebuilder stocks. An index of homebuilders has returned +45% in the past 12 months and +91% in 5Y. Beazer, however, has not fully participated in these gains (+16% in 1Y, +13% in 5Y). It trades on 0.5x tangible book compared to a median of 1.5x for peers. Admittedly, there are warts. Beazer has a relatively poor long-term track record, having barely survived the 2008 housing crash. Net debt-equity is higher than peers at 76%. It also lacks the scale of the larger players. Nonetheless at the current price it offers a cheap entry into an attractive industry. A re-rating to $28, a gain of 64%, may be in the cards.

History

Beazer’s roots go back to 1985 when a UK developer acquired an Atlanta-based homebuilder. Beazer was formed in 1993 in anticipation of an IPO of the American business, which occurred the following year. After listing Beazer expanded via acquisition and also established a mortgage origination company. By the late 1990s it was a top 3 homebuilder in several markets, including Nashville, Sacramento, Jacksonville, Charlotte, and Phoenix.

It continued to grow and by 2002 it was the nation’s 6th largest homebuilder. 09/2006 revenue topped $5 b.

Then the tide went out. The company posted 7 consecutive years of net losses (09/2007-09/2013) due to a collapse in revenue and asset impairment. But it survived. As it liquidated inventory, operating cash flow turned positive. It issued new shares, cut costs, and exited several local markets. Despite these measures net debt-equity was still 419% in 09/2013.

The housing market downturn coincided with some improprieties surfacing. The company’s mortgage origination practice did not comply with legal requirements. There were also accounting and reporting errors/irregularities, resulting in restatement of financials. Slowly, management was pushed out (the CEO in 2011 and Chairman in 2014).

The year ending 09/2014 marked the beginning of a recovery.

Operations

Homebuilding starts with land acquisition and development. Beazer typically purchases land after entitlements have been obtained, which allows it to apply for building permits and move forward with construction. Design plans are prepared by the company. It serves as general contractor and subcontractors do the construction. Subcontractors are typically compensated on a fixed price basis and win projects based on competitive bidding. Beazer purchases materials and in some instances has regional or national supply contracts.

Unlike some peers, which operate in adjacent areas such as financial services and rental housing, Beazer is purely a homebuilder. It operates in 13 states, primarily in the Sunbelt. It reports 3 segments – West, Southeast, and East. In recent years >50% of closings have been in the West segment. Its average selling price last year, $484,100, is similar to peers. It attempts to differentiate itself from other homebuilders with greater floor plan flexibility and energy efficiency, though these claims are difficult to verify. In addition to single family housing communities, it has a separately branded ‘Gatherings’ offering of condominiums which are age-restricted to 55 and above.

Beazer operating footprint

As of March, its backlog and land bank data:

· It has a backlog of 1,858 homes at an average price of $531,000, equal to $987 m (43% of 09/2022 revenue).

· It is constructing homes in 123 communities.

· It controls ~24,000 lots through a combination of ownership and purchase option agreements. Based on average closings of ~5,400 per annum in the past 5 years, this suggests equates to ~4.5 years of land supply.

Business quality

There are no barriers to entry in the homebuilding business. Any local firm can acquire land, engage architects and engineers to design homes, and hire contractors to do the building. Independent real estate agents can provide sales & marketing.

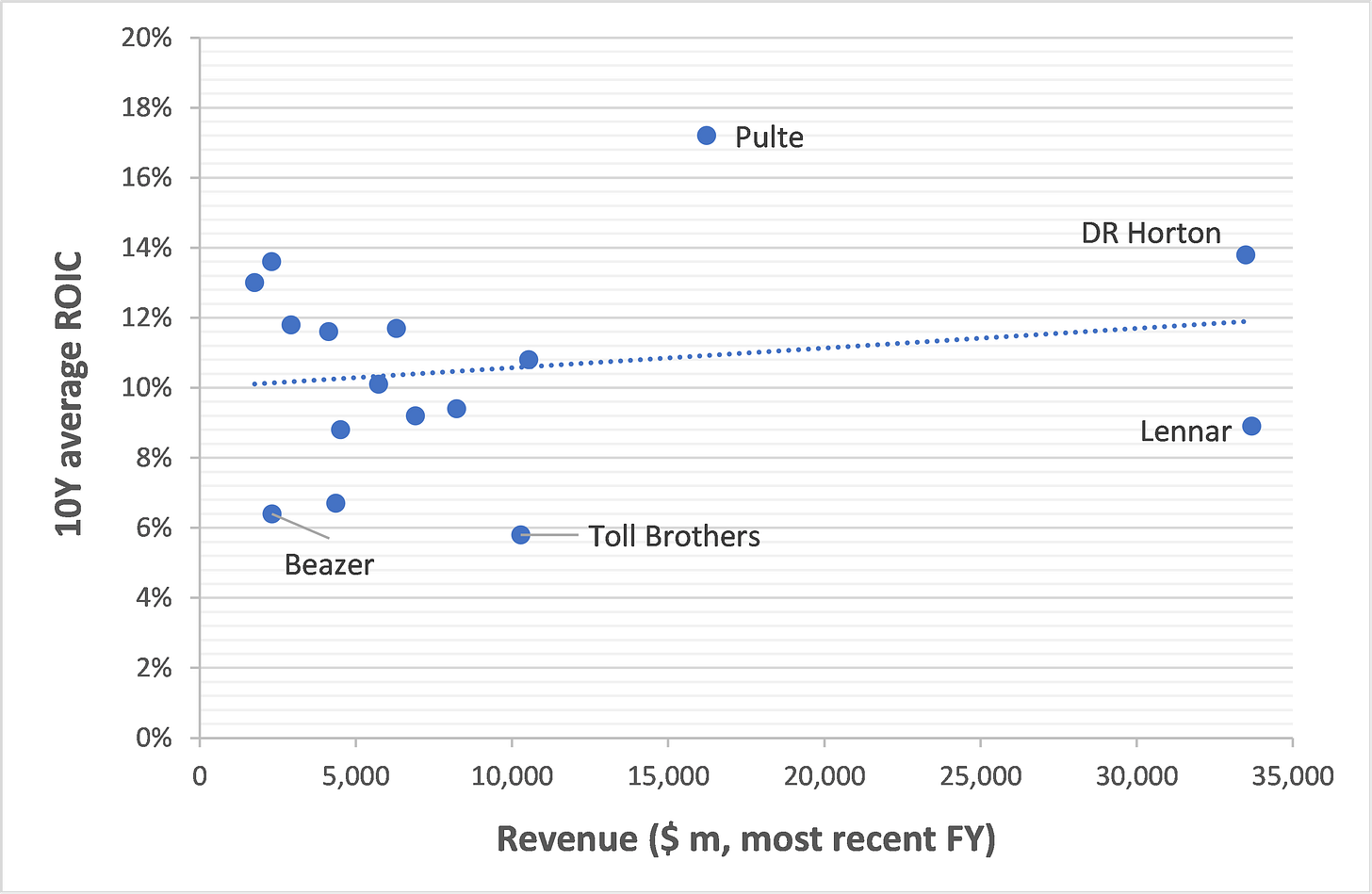

One industry report estimates there were 66,000 homebuilders in the country in 2017. Of these, 75% are small with annual revenue of <$1 m. There are 2 giants, Lennar and DR Horton, which each have ~$30 b in homebuilding revenue and represent a combined ~15% of the market. The top 10 players are ~30% of the market. Beazer may rank within the top 15.

Beazer’s 10Y average ROIC of 6% suggests it has limited competitive advantages. The average ROIC for the last 3 years, 11%, is encouraging though is surely flattered by the strong housing market. Within the industry, Beazer’s returns have been poor. Larger players are better able to generate economies of scale. They can exert bargaining power with suppliers, subcontractors, and land developers. They can better leverage general operating costs, including investments in technology.

Homebuilders - Revenue and ROIC

So what specifically has driven this low ROIC?

The gross margin is relatively low for Beazer. This may reflect the issues of bargaining power as noted above. Another factor is the burden of capitalized interest, which is included in the cost line as homes are sold. For Beazer, capitalized interest has reduced the gross margin by 3-4 percentage points in recent years. For less leveraged players, this cost is less of a consideration. For example at DR Horton, homebuilding segment only, the reported gross margin is 28.5% compared to 29.0% ignoring capitalized interest.

Beazer Homes – gross margin trends

Beazer isn’t able to leverage SG&A to the extent of peers. For Beazer, this line was 11% of revenue in 09/2022, similar to peers of its size. For DR Horton, looking just at the homebuilding segment, the figure was 7%.

Inventory turnover is broadly in line with peers. In 5Y, the average for Beazer has been 313 days.

Overall, homebuilders face challenges. In addition to a slew of competitors, the business is capital intensive, exposed to burdensome local regulations, lacks recurring revenues, and is sensitive to interest rates.

There are also attractive features to homebuilding.

Cash flow strains are mitigated through two common practices. First, land can be acquired through entering into option agreements with sellers. Typically, a homebuilder will pay a non-refundable cash deposit or issue some form of guarantee for the right to acquire lots. The maximum potential loss to the homebuilder is the value of the deposit. In the case of Beazer, 54% of controlled lots are via option agreements. Second, homes are pre-sold, with buyers paying deposits when the contract is signed, though these deposits are relatively small as % of the home value (<5%) and are often partially or fully refunded if the buyer cancels the contract. Nonetheless these pre-sales reduce the risk of completed homes sitting unbought for a long period of time.

Another consideration is that homebuilding is an inflation hedge. The inevitable lag from land acquisition to sale of a newly constructed home can work in the builder’s favor.

Finally, homebuilding is a growth industry. Since the 2005 peak the construction of new homes has not kept pace with population expansion.

Residential housing completions & USA population

Cyclical trends

The market for single family homes is adjusting to the reality that houses are less affordable now. Home prices reached all-time highs in 2H 2022 and sub 3% mortgages are a distant memory for new buyers. One calculation shows new home buyers were paying >35% of income on mortgage payments in late 2022 compared to 16% two years earlier. Inventories of new homes remain elevated though are off the peak. Building permits and homes under construction peaked months ago.

Median home prices and 30-year fixed rate mortgage rate

Single family homes – supply indicators

This noted, there may be some green shoots. The most recent nationwide data for housing prices, published by Zillow, shows MoM prices were positive in February and March, which followed 6 months of negative MoM prints.

Housing price changes – Beazer markets

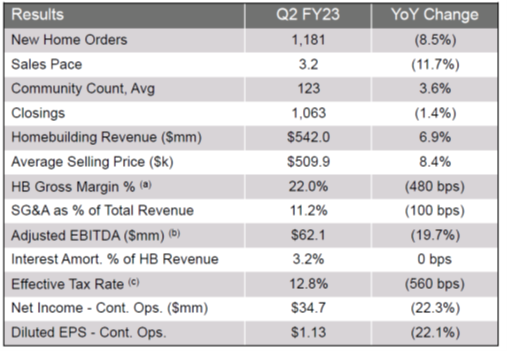

The housing market adjustment is adversely impacting Beazer’s results. In 6M ending 03/2023 earnings declined 26% YoY.

Beazer – March 2023 quarterly results

Balance sheet health

Leverage remains relatively high though has continued to decline. As of March 2023, net debt is 76% of shareholders equity (versus 106% in 09/2022) Debt characteristics:

· Interest coverage - it paid cash interest of $70 m in the recent fiscal year. 09/2022 EBIT was 3.9x this amount, though on ‘through the cycle’ coverage is 2.6x.

· Interest rate exposure – floating rate debt, <10% of total, is in the form of junior subordinated notes, for which payments are 3M LIBOR + 245 bps, with a portion capped at 9.25%.

· Debt maturities - one note matures in March 2025 (carrying value of $211 m) with the remaining maturities 2027 and beyond.

· Access to credit – an unsecured revolving credit facility allows it to borrow $265 m with some scope for this to be increased to $400 m. Any drawdowns would be at a floating rate of interest, which would likely be 210-310 bps off the SONIA rate in addition to a 40 bps commitment fee.

Overall, it would be prudent for Beazer to lower leverage further given the rate environment. This noted it faces no imminent debt repayments nor exposure to higher rates.

On the asset side of the balance sheet, the major risk is potential impairment of inventory. Inventory impairment has occurred every year for the past decade. In most years the figure is <$5 m. The major exception was 09/2019, when the charge was $149 m. This large impairment was a legacy issue – related to assets in California acquired prior to 2007. This was a time in which the company and industry overall exhibited poor land acquisition decisions. It is difficult to know how aggressive Beazer has been in acquiring land – assuming no major downturn in the housing market material write-downs are unlikely.

Management & corporate governance

Insiders own 6% of outstanding shares. The Chairman & CEO (Merrill) accounts for >half of this amount. Insider ownership has been increasing. Executives and other directors are required to hold a certain number of shares, for example the CEO must own 5x base salary.

There are 3 institutions which have >5% - BlackRock, Capital, and Donald Smith.

There are 8 directors, including the CEO & Chairman. The remaining 7 are considered independent and non-executive, though 1 of these has been on the board for ~11 years. Directors are credible, with backgrounds in accounting & finance, homebuilding, and technology.

Merrill was appointed CEO in 2011, having been recruited from outside the company to be CFO in 2007. He is 56 years old. The two other key executives are the CFO (Goldberg), in the role since 2020 and with the company since 2015, and the General Counsel (Belknap), in the role since 2018.

Key metrics for executive compensation:

· ST incentives – adjusted EBITDA is 75% of the determinant.

· LT incentives – pre-tax profit, ROA, Gatherings metrics, and total stock return relative peers.

All in, the CEO earned $7.0 m in 2022 and the other 2 executives $2.4-2.7 m.

Valuation

One indicator of value is the 0.5x multiple to tangible book of $31.55 per share. Since 09/2010 the average multiple has been 0.9x.

Looking at earnings, 09/2022 is probably a peak of cycle earnings and 09/2023 is likely to be weak. Management guides for EPS of $4.00 this year, which would be a 44% decline. A ‘through the cycle’ EPS estimate is $4.79, to which the shares trade on <4x. ‘Through the cycle’ free cash flow is $115 m, which is a ~9% yield to the EV. A share price of $28 implies 5.9x through-the-cycle earnings and 0.8x tangible book value.

Beazer – earnings & valuation

Disclosure: The author of this report does not own shares in Beazer Homes USA though may purchase the shares in the future.

Disclaimer: The information contained in this report is for general informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities or other financial products. The opinions expressed in this report are those of the publisher and are subject to change without notice. Readers are advised to conduct their own research. The publisher does not guarantee the accuracy, completeness, or reliability of any information in this report, and disclaims any liability for any losses or damages arising from the contents of the report.