How much is ~17,000 acres of land on the outskirts of Albuquerque, New Mexico worth? Surely a lot more than the carrying value on AMREP Corp’s (ticker AXR) balance sheet. The shares may be worth $47, or as high as $74 on an optimistic case, compared to the $22 current price.

Background to this report

I blogged about AMREP Corp in early 2023, noting that there was hidden value in the company’s land holdings. AMREP shares were at $12 then.

So now, the shares sit at $22. The release of the 10-K for the FY ending April 2024 is a good opportunity to update the valuation assumptions.

Conclusion – my optimistic case puts the shares at $74 while the pessimistic case yields $47. There will be no quick re-rating given the nature of operations. Instead, expect a slow, steady appreciation in the share price.

History

In the 1960s AMREP purchased ~55,000 acres of land north of Albuquerque, New Mexico. In the early 1970s it acquired another ~35,000 acres in the region. The development became known as Rio Rancho. AMREP marketed the property to out-of-state individuals interested in retirement homes or investment opportunities. Intel’s decision to build a plant in Rio Rancho in 1981 represented a boon for AMREP.

AMREP then went through a period of ‘diworsification’ – it expanded its development operations to other states and engaged in unrelated businesses (including media-related services). Ahead of the 2008 housing meltdown these unrelated businesses grew in importance and the company paused housing development, though did make land sales to developers. Beginning 04/2009 the media services business began to decline.

In 04/2020 it restarted housebuilding operations.

Operations

Most of AMREP’s activities are in Rio Rancho, New Mexico and adjoining areas of Sandoval County, New Mexico. Rio Rancho is the 3rd largest city in New Mexico with a population of 111,000 and is adjacent to the northwest of Albuquerque. The population has continued to increase – from 33,000 in 1990, 52,000 in 2000, and 88,000 in 2010. Rio Rancho hosts a modest tech industry – Intel is the largest employer with 2,600 workers and manufactures advanced packing there. In 2009 HP began to construct a technical support and customer service site – it is now the 3rd largest employer. Rio Rancho receives good press – Fortune included it in its list of ’50 Best Places to Live for Families in the US’ and Motley Fool listed it amongst the ’10 Most Affordable Cities in the West’.

AMREP reports two primary segments:

1) Land Development – the company owns ~17k acres in Sandoval County. AMREP markets both developed and undeveloped land to homebuilders, commercial/industrial developers, and others. It engages in land & site planning, obtaining approvals, installing utilities and drainage, building or improving roads. It uses outside contractors for development work. It opportunistically acquires additional land. Land development is typically 65% of revenue.

2) Homebuilding – offers a variety of floor plans and designs at different prices. It uses subcontractors to do the work. It draws on the landbank.

Recent Trends

Land sales in FY April 2024:

· Sales of developed acres were lighter than in recent years – it sold 30 acres (28 residential, 2 comm’l / industrial) compared to >50 acres in the past 3 FYs.

· Sales of undeveloped land were relatively high at 223 acres. Of this, 147 acres was an odd lot parcel located in Colorado, which doesn’t have any read-across to the New Mexico landholdings.

· Realized prices on land sales were encouraging. Residential went for $666k per acre, a new high. Comm’l/industrial land prices were soft, though with just 2 acres of sales, it is difficult to read too much into this. Undeveloped land, excluding the Colorado site, went for a healthy $7.3k per acre.

Homebuilding segment results:

· Revenue was flattish with the gross margin weaker at 25% from 28%. It sold fewer than 40 homes annually in both years.

Zillow shows the housing market in Rio Rancho has been healthy despite interest rate increases. Most recently home prices were 6% higher YoY.

Valuation

First, the pitfalls in attempting to value AMREP’s land:

· Past transactions may not be indicative of future prices – there is a risk that the most prime bits of land have been sold and what remains is in areas which, for now, are less attractive.

· There is the issue of timing and whether the market can absorb the supply. In the case of commercial/industrial, it has sold just 22 acres since 04/2012. This compares to the current inventory of 65 acres, in addition to the 117 acres under development. Residential looks better in this regard, though still challenging. It currently has ~31 acres of developed residential (assuming 4 lots per acre) with another 367 acres under development. Since 04/2012 it has sold 364 acres. Ditto for undeveloped land. Unless it opts for a quick liquidation, which could happen at low prices, AMREP may be working through the landbank for many years.

Next, a profile of the land bank. Of the ~17,000 acres owned in New Mexico’s Sandoval County, the mix is:

· Developed residential – AMREP discloses ‘lots’, an unprecise measure, rather than acres in discussing these holdings. There are 125 lots. If we assume ~4 lots per acre, this yields 31 acres.

· Developed commercial / industrial – there are 65 acres. Roughly half is in the Commerce Center at Enchanted Hills. This appears a prime location at the intersection of two major roads and surrounded by residential and an existing base of commercial/retail development.

· Under development – residential - 367 acres.

· Under development – commercial / industrial – 117 acres.

· Undeveloped – the remaining amount, which comes to ~16,000 acres. In past 10-Ks, the company noted that ~20% was highly contiguous (>90% contiguous), and ~30% was moderately so (50-90% contiguous). This is an important distinction; in that it increases the demand for large-scale developments.

AMREP discloses historical transactions by land type, which is a useful starting point in valuing the land portfolio. Here is the data:

· Developed residential – since 04/2011 it has sold 367 acres of this type of land for $150 m, or $409k per acre. The recent trend has been for rising per acreage prices – from $422k in 04/2020 to $666k in 04/2024.

· Developed commercial – since 04/2011 it has sold 22 acres. The average per acre price has been $605k.

· Under development – AMREP has never separately disclosed such transactions. Presumably it makes sense for AMREP to complete any development work prior to selling any land.

· Undeveloped – there have been wide swings in the annual realized per acreage price. The low was 04/2020 at $2,600 per acre. The high was in 04/2011 at $38k per acre. In sum, since 04/2011 it has sold ~1,900 acres at an average price of $7,400 per acre (excluding some land sales in Colorado last year).

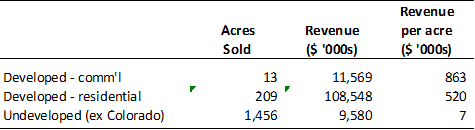

Land disposals: revenue per acre ($ ‘000s)

Taking an average of the past 5 FYs, on a per-acre basis, it has sold comm’l land for $863k, residential for $520k, and undeveloped land (excluding Colorado) for $7k.

Land disposals from 04/2019 to 04/2024

So how much is all this land worth? Based on historical trends, data on real estate websites (Zillow and others) and whatever tidbits publicly available, my guestimates are:

· Developed residential – a range of $700k to $450k per acre.

· Developed commercial – a range of $900k to $400k per acre.

· Under development – have used the same assumptions as per the developed land and subtracted additional costs to develop. Works out to a 35% gross margin (excluding any development costs already expensed) which is similar to past levels.

· Undeveloped – a range of $7k to $4k.

· Other lots – this is mostly developed land in Sante Fe, New Mexico.

The company carries the land at $67 million on its balance sheet. This is at cost in addition to development costs, etc. It looks to be worth $237-419 million, depending on the assumptions. Assume a 22% tax rate and the tangible book value per share becomes $74.5 to $47.5 compared to the $22.4 reported.

A few more bits to note

It has a conservative financial position. Total liabilities, virtually all payables and accrued expenses, are $5 m versus assets of $123 m.

The company also owns mineral rights under 55,000 surface acres in Sandoval County, New Mexico. There was no revenue from this last year.

The shares are tightly held, with 4 shareholders (including 2 directors) owning 59%.

There are 4 directors:

· Edward Cloues is the Chairman. Age 76. Has been in the position since January 1996. He owns <1% of the company. He is a Harvard grad and has served on several boards (currently Virtua Health) over the years. He is an attorney and was CEO of K-Tron International (acquired by Hillenbrand in 2010).

· Albert Russo, aged 70, has been on the Board since 1996. He owns 15% of the company and his family members own an additional 8%. His background is in commercial real estate.

· Bob Robotti, aged 71, has been on the Board since 2016. He owns 10% of the company. He is a money manager with his own firm and sits on numerous boards.

· Christopher Vitale, aged 48, joined the Board in 2021. He has been the CEO since 2017 and with the company since 2013. He owns 2% of the company.

There has been consistent insider buying.

Management have been good stewards of capital. While it has not paid a dividend in the last decade, it repurchased shares in FYs 04/2021 and 04/2022, reducing the share count to 5.2 million from 8.1 million. AMREP is sitting on cash of $30 m, equal to 25% of the market cap.

Disclaimer: The information contained in this report is for general informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities or other financial products. The opinions expressed in this report are those of the publisher and are subject to change without notice. Readers are advised to conduct their own research. The publisher does not guarantee the accuracy, completeness, or reliability of any information in this report, and disclaims any liability for any losses or damages arising from the contents of the report. The publisher of the report often invests i n companies about which it writes.

Very interested when I see Bob Robotti heavily involved.

Great article. Well explained — earnings have significantly reduced in FY24, despite increase in revenue, why is that?